Bitcoin-Native Startup and Venture Capital Landscape in 2023 - Report

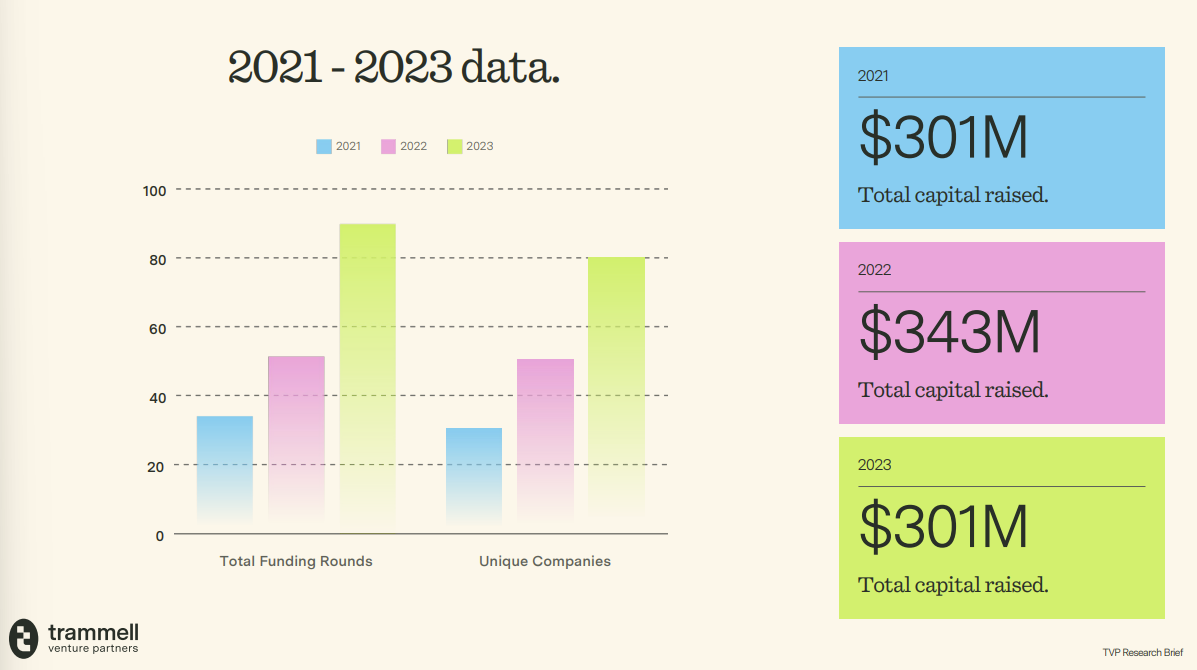

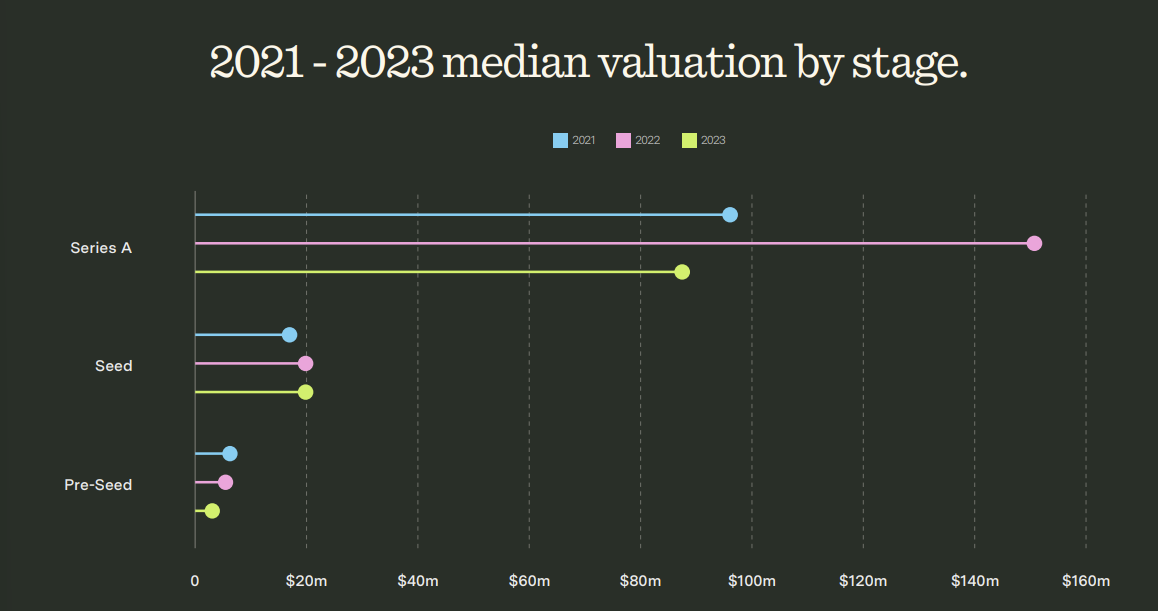

Trammel Venture Partners announced its second annual research brief on Bitcoin-native startups and related venture capital ecosystem. This research brief represents three years of data and subsequent analysis of the early-stage Bitcoin startups.

- “The early indicators from the TVP research are in line with the expectations we have had for ‘crypto’ venture’s end state: founders really want to be building on Bitcoin specifically,” Christopher Calicott, TVP's managing director and founding partner, told Bitcoin Magazine.

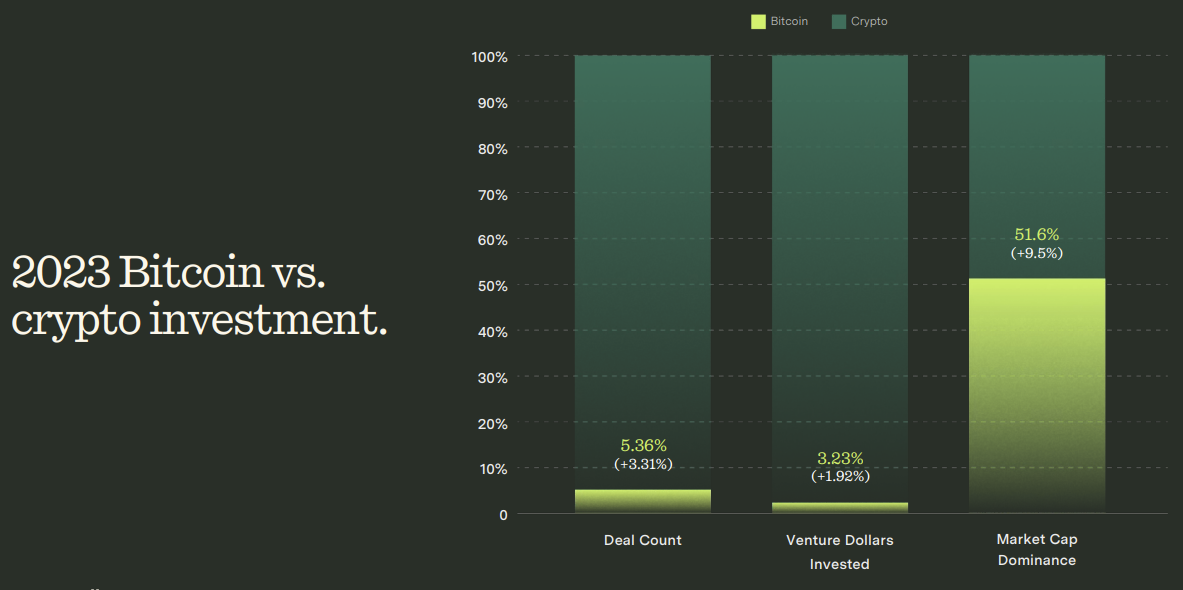

"Due to cyclicality and bitcoin’s institutional embrace, its market cap dominance is even greater than at the time of our 2023 report. Despite this, allocation to Bitcoin-native venture capital remains very low, relatively speaking. We believe that delta will begin to close as more allocators start to see the compounding benefits from a rapidly expanding design space on Bitcoin thanks to these early-stage Bitcoin startups," he added.

Key findings:

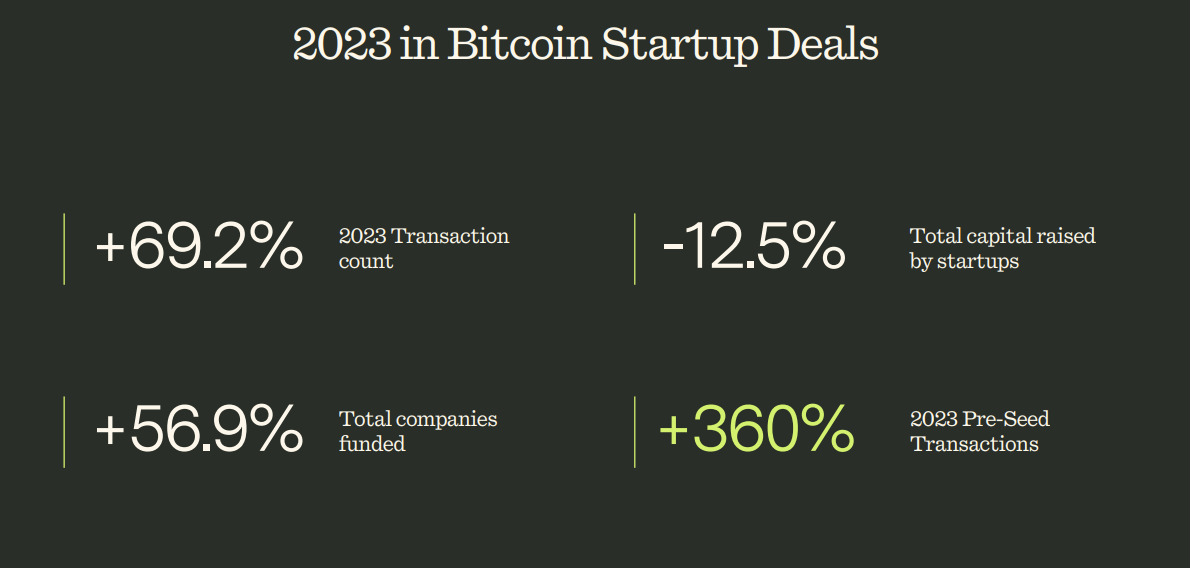

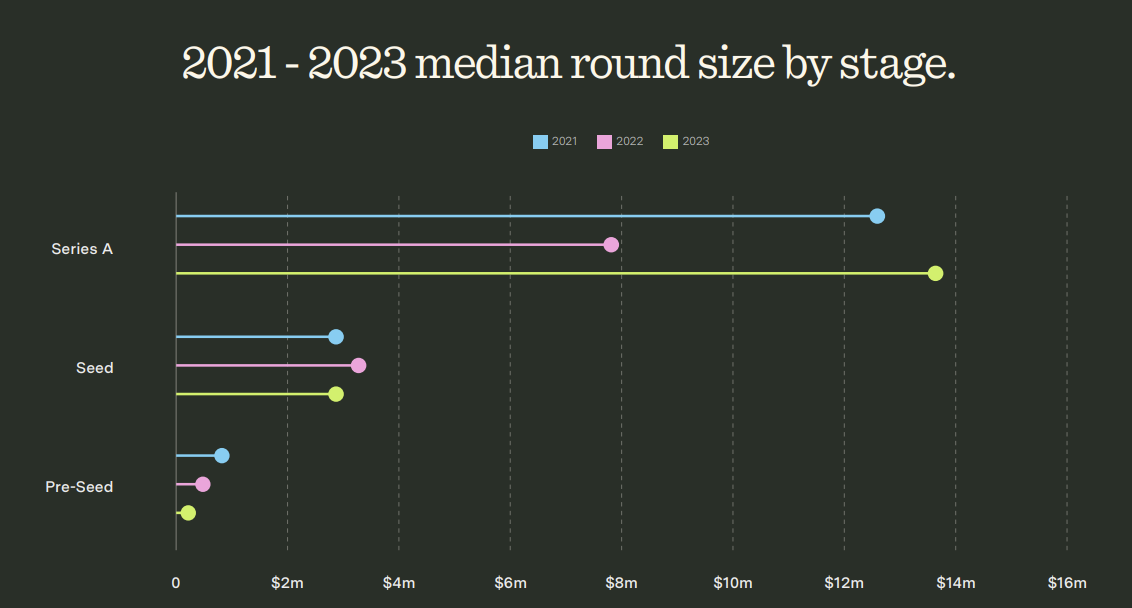

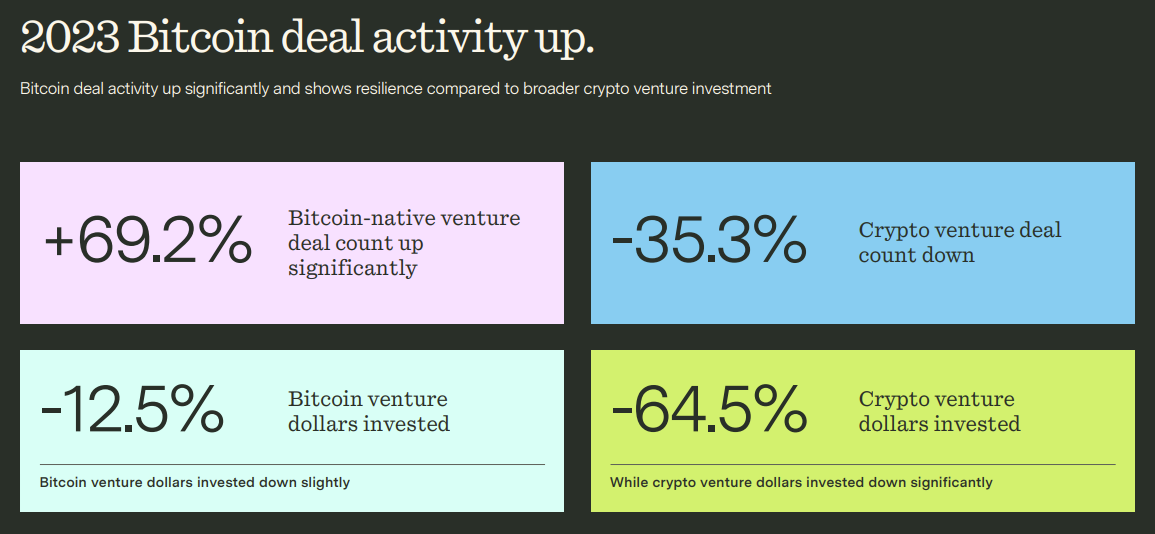

- The report highlights a 360% year-over-year rise in Bitcoin startup deal transaction count, although the total amount of capital raised declined by 12.5% in 2023. Meanwhile, the total amount raised by 'crypto' startups was down by 64.5%.

- Bitcoin-native venture deal count grew significantly, rising 69.2%. At the same time, the broader crypto venture deal count declined by 35.3%.

- Contributors to this research brief are Christopher Calicott, Matthew Snow, and Zach Young.