AnchorWatch Launches in the U.S. for Customers Holding Between $250K & $100M in Bitcoin

AnchorWatch is a pioneering insurance provider specializing in collaborative bitcoin custody. It combines the advanced security features of Trident Vault with insurance from Lloyd's of London syndicates. The service is currently available for retail and commercial customers in the United States.

"We’re thrilled to announce the Grand Opening of AnchorWatch and welcome you to safer bitcoin storage. For the first time ever, you now have access to truly insured custody - without giving up your keys," announced the company.

- AchorWatch is a Lloyd’s of London Coverholder with binding authority of up to $100M per customer.

- The company aims to transform Bitcoin custody with its Trident Vault software, leveraging Bitcoin’s smart contracting language for features like timelocks, multiple spending conditions, and multisig quorums. This ensures strong security and governance facilitated at the Bitcoin protocol level, while embedded regulated insurance reduces risks from theft, kidnappings, and fraud.

- Trident Vault goes beyond traditional collaborative custody products built on legacy multisig by utilizing miniscript, offering two key advantages:

- Time-locked recovery paths: This feature allows Bitcoin to be recovered using different combinations of keys over time.

- Multisig of multisigs: This enables AnchorWatch to be a required signer on transactions while you're insured, ensuring that we can never unilaterally control a customer's Bitcoin.

"When you combine these two features, it means that you get extra protection while insured, but after your policy ends, the vault seamlessly becomes pure self-custody where you don't need us at all. If you want to renew your policy, then we 'restart' the clocks on the time locks and put you back at full protection," explained the company.

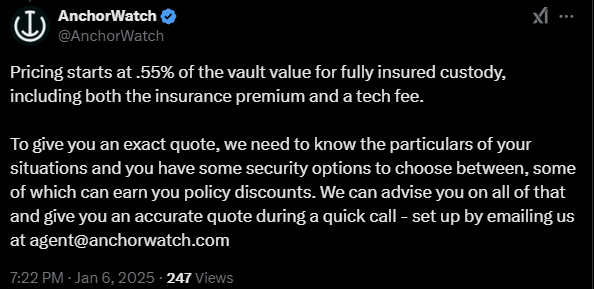

- The service is currently available for retail and commercial U.S. customers who hold between $250K and $100M in bitcoin.

"Stay tuned for expansion to additional countries. In the meantime, we can insure American LLCs that hold bitcoin. There are bitcoin attorneys that can help you quickly set up a LLC in the US that you wholly own," said the firm.

"We're a bitcoin company that truly understands the risks you face as bitcoin owners - we've built our custody solution and crafted the insurance policy to provide you with maximum protection from whatever life throws at you," was stated in the announcement.

The recording of the Q&A session from the launch is available here.

Announcement / Archive

Website FAQ

- Do you want more? Subscribe and get No Bullshit GM report straight to your mailbox.

- Follow No Bullshit Bitcoin on Nostr.

- Feedback or news tips? Drop it here.