ARK 21 Shares ETF Diversifies Bitcoin Custodians with Anchorage Digital and BitGo

With this move, the ETF issuer aims to enhance safety and security from online threats, hacking, and cyber-attacks, while increasing diversification in the digital asset investment landscape.

- "Anchorage Digital and BitGo join Coinbase as custodians for 21Shares US spot products, including the ARK 21Shares Bitcoin ETF, ARKB, and the 21Shares Core Ethereum ETF, CETH," announced 21Shares.

"21Shares is thrilled to be working with Anchorage Digital and BitGo to diversify our custodians for our US spot ETPs. We consider our custody partners to be crucial to the risk management and operational excellence of our product lineup. Diversifying custodians adds to the safety and security from potential online threats to our offering," said Andres Valencia, Head of Investment Management at 21Shares.

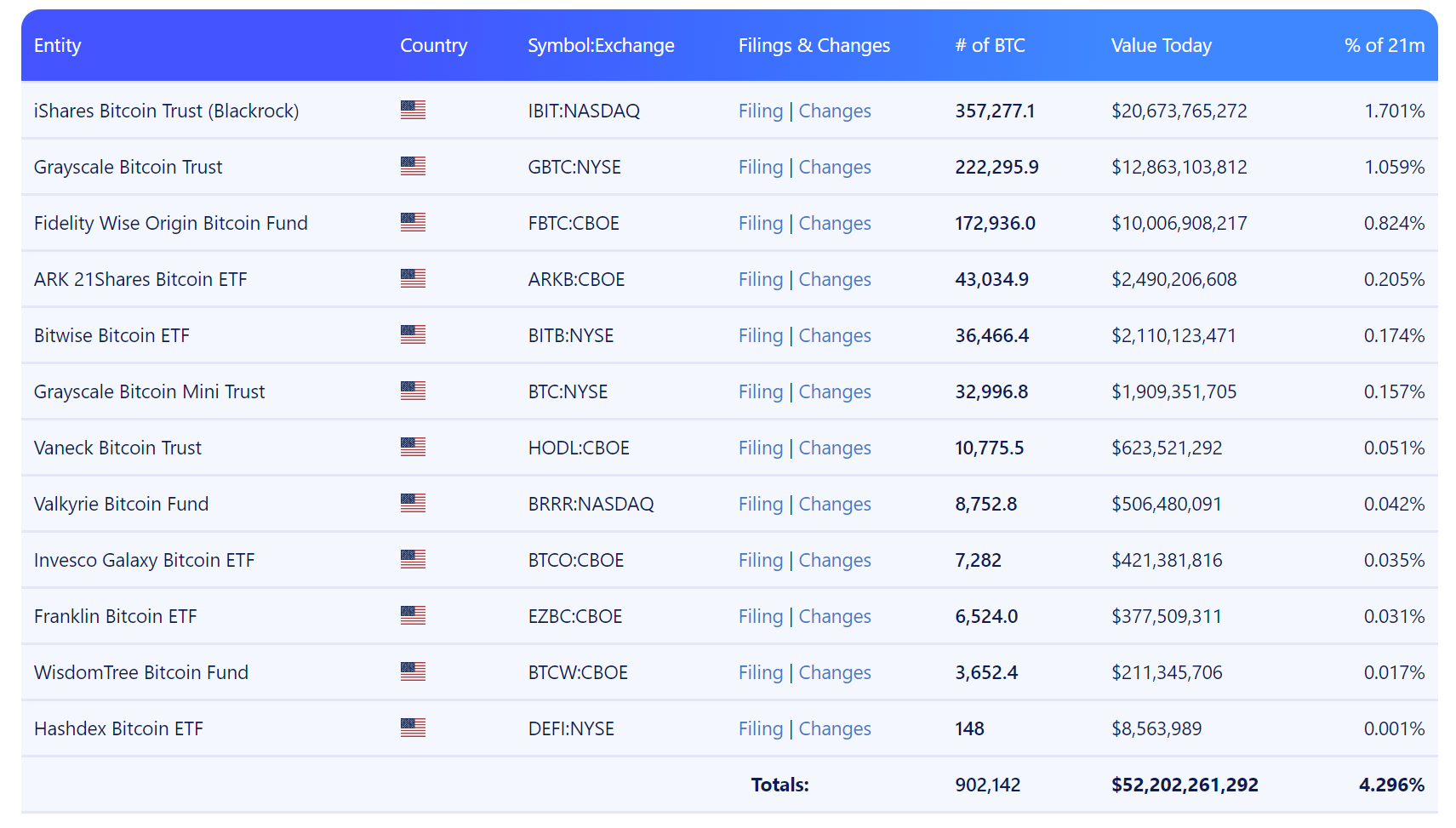

- The custody extends to ARK 21Shares Bitcoin ETF (ARKB), which holds the fourth spot for net inflows, according to rankings from Bitbo.

"Our federal charter—which supersedes state-by-state regulation and positions us as a qualified custodian—makes us a natural choice for ETP custody diversification," said Anchorage CEO Nathan McCauley.

- Coinbase has been a leading provider of custody services for U.S. exchange traded products (ETPs) so far. Fidelity self-custodies and VanEck uses Gemini. 21Shares is not the only issuer to diversify its custody providers. Earlier this year, Valkyrie added BitGo as an additional custody provider for its Bitcoin Fund (BRRR).

"We're excited that 21Shares is adopting a multi-custodial approach, prioritizing security for ETP holders. BitGo is proud to offer 100% cold storage as a leading independent custodian, serving the industry for over a decade as a trusted partner for ETP issuers," said Mike Belshe, CEO of BitGo, which now boasts of being a custodian for four ETF funds.

- Custody may be a growing issue in the space. Last year, The U.S. Securities and Exchange Commission (SEC) proposed a rule for registered advisers to use "qualified custodians" for client assets. If SEC Chair Gary Gensler's narrow definition is adopted, only a few firms like Anchorage Digital, Prometheum Inc., and tZero Group Inc. may qualify.

Press Release / Archive

BitGo Blog Post / Archive

Anchorage Announcement / Archive

Blockworks Article / Archive

CoinDesk Article / Archive