Bitcoin Fundamentals Strengthen As Recession Looms - ARK Report

"Long-term-holder activity and strong network usage indicate a bullish trend for bitcoin," says The Bitcoin Monthly report by ARK Invest.

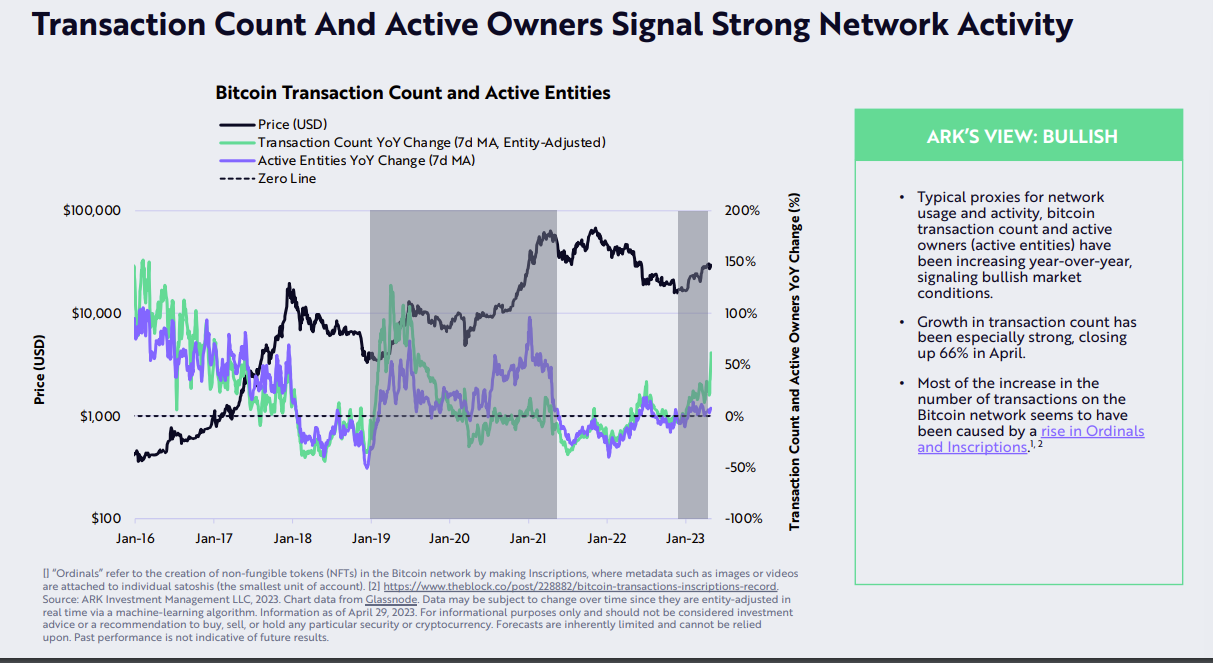

- "A boost in transaction count and active owners signaled strong network activity and a bullish market."

- "Long-term-holder spent output price ratio (SOPR) surpassed 1, suggesting the market is trading at a profit."

- "Bitcoin’s 200-week moving average ($25,900) and realized price ($19,950) remain strong support levels for bitcoin."

- "The US Leading Economic Index (LEI) fell for the twelfth straight month, signaling the high probability of a recession."

- "1-month T-bill inversion with the Federal Funds Rate (FFR) may indicate impending rate cuts or investor concerns over the debt ceiling."

- "Continuing jobless claims continued to increase, a trend historically associated with recessions."

- "US economic indicators—including the Conference Board Leading Economic Index, T-bill inversions, and unemployment insurance claims—suggest that a recession is looming."