Bitcoin Ownership Is Rising As More People Hedge Currency Devaluation, Failing Banks

Bitcoin adoption tends to be higher in countries with capital restrictions, financial instability, and political instability but the ongoing turbulence in the U.S. banking system is making Americans worry as well.

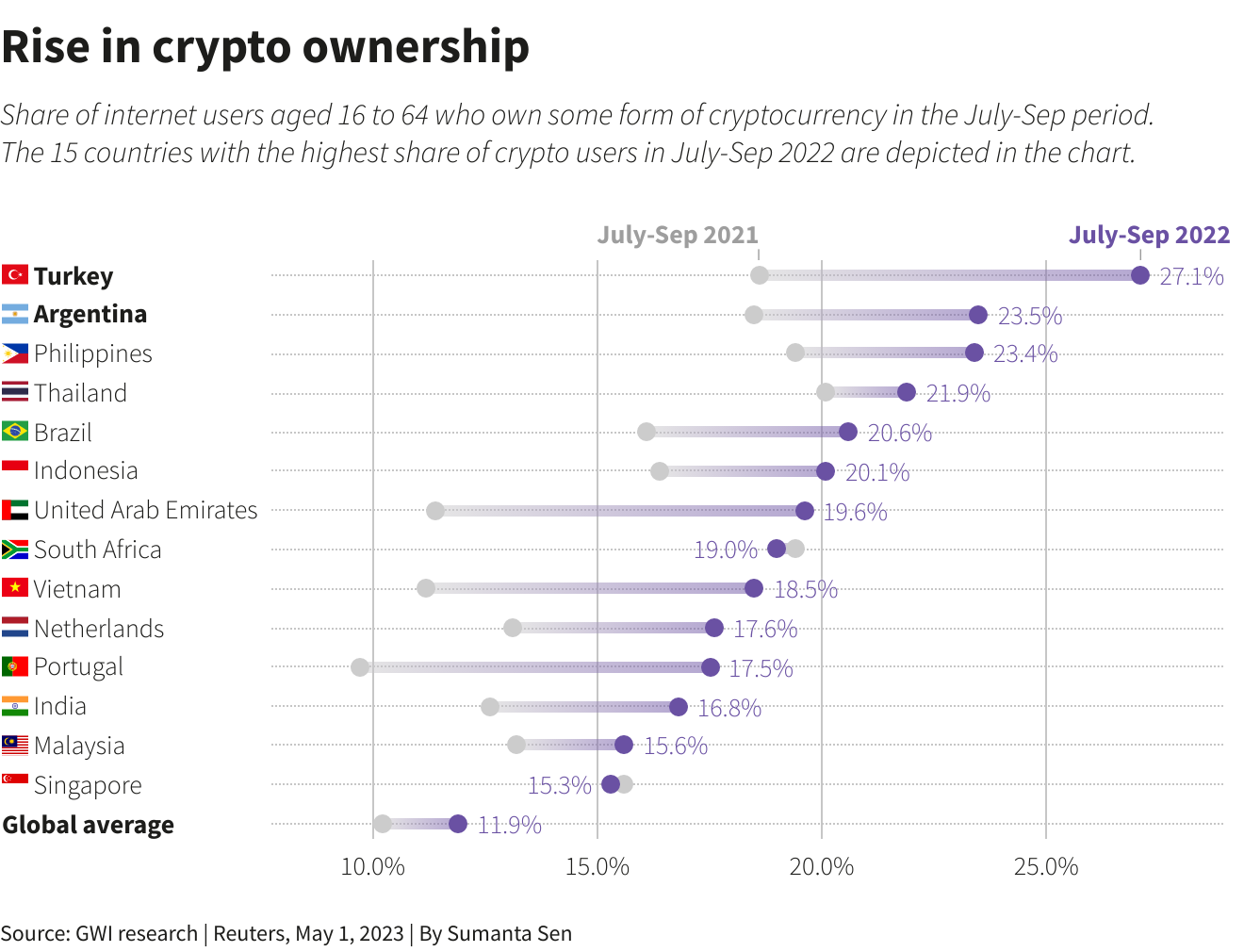

- "Ownership of digital currencies in Turkey was the highest in the world at 27.1% followed by Argentina at 23.5% - well above global crypto ownership rate estimated at 11.9% - according to data from research firm GWI."

- "The lira and peso have been plunging and are at record lows. Argentina's peso trades around 464 per dollar in the black market , more than double the official exchange rate of 222."

- "Trading volume for the USDT-Turkish lira pair reached a multi-month high last week, driven by the weakening of the Turkish currency and the upcoming landmark presidential and parliamentary elections."

- "Much of the safe-haven buying has been of stablecoins such as USD Coin (USDC) and Tether (USDT)."

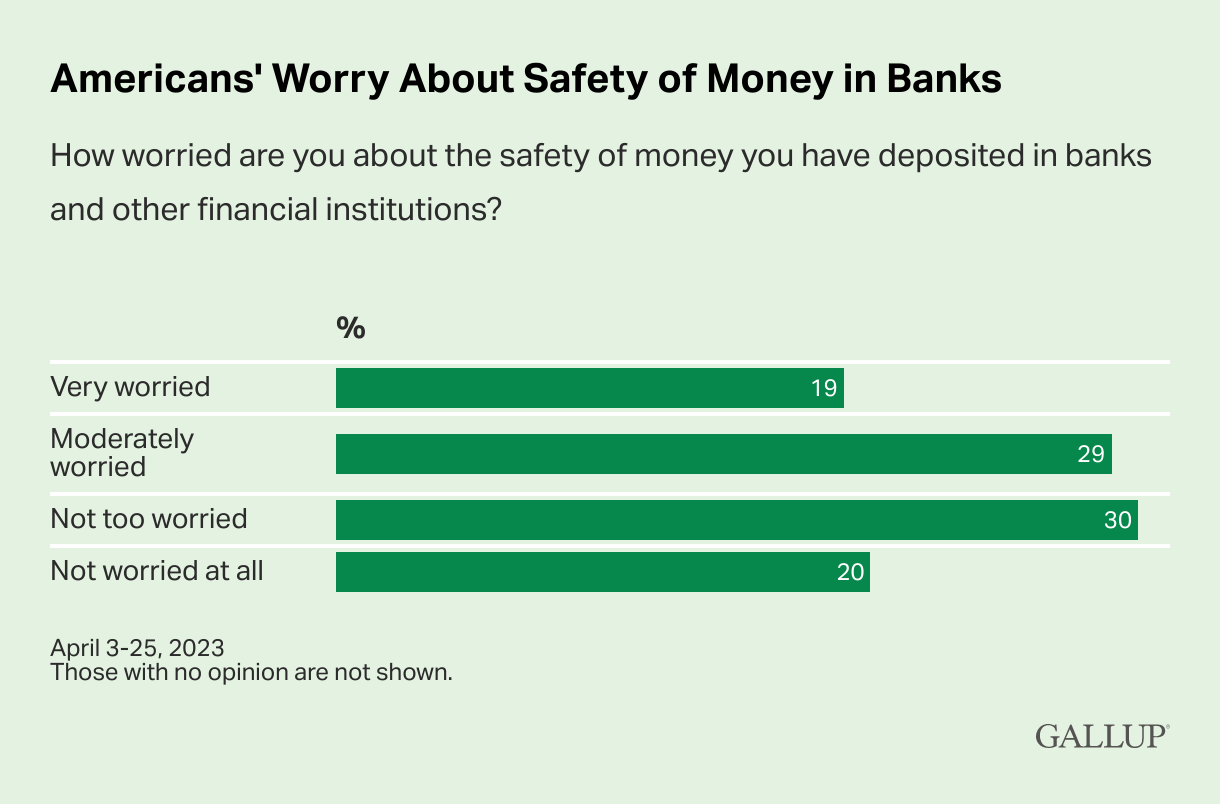

- Meanwhile in the United States, nearly half of Americans are anxious about the safety of the money they have in accounts at banks or other financial institutions, Gallup research shows.

A total of 48% of U.S. adults say they are concerned about their money, including 19% who are “very” and 29% who are “moderately” worried. At the same time, 30% are “not too worried” and 20% are “not worried at all.”

- The latest readings are higher than those recorded amidst the peak of 2008 financial crisis. "In September of that year, shortly after the collapse of Lehman Brothers, which remains the largest bankruptcy filing in U.S. history, 45% of U.S. adults said they were very or moderately worried about the safety of their money."

- According to Goldman Sachs Family Office Investment Insight Report 2023, there are more family offices are currently invested in cryptocurrencies than in 2021 – 26%, up from 16%, with the most-cited rationale being their “belief in the power of blockchain technology.”

Reuters Article / Archive

Gallup Research / Archive

Goldman Sachs Report / Archive