Bitcoin Spot ETFs Now Manage Over 1 Million BTC, BlackRock Flips Grayscale

BlackRock’s iShares Bitcoin Trust (IBIT) now holds more BTC than Grayscale Bitcoin Trust ETF (GBTC). Bitcoin Exchange-Traded Funds globally now manage over 1 million BTC.

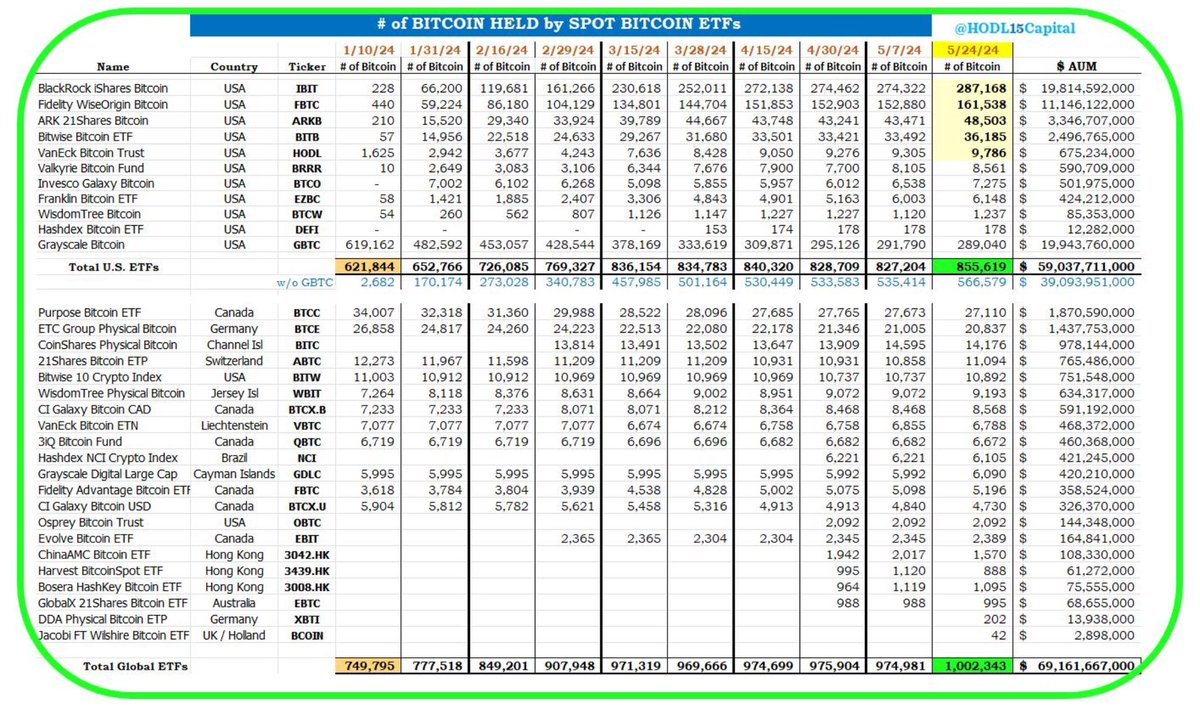

- According to onchain data as of May 24th, Bitcoin ETFs held 1,002,343 BTC, valued at nearly $68 billion. This constitutes around 5% of the current circulating supply of bitcoins.

- This includes 855,619 BTC from 11 spot ETFs launched in the United States in January, and 21 ETPs from countries like Canada, Germany, Sweden, Hong Kong, and Brazil.

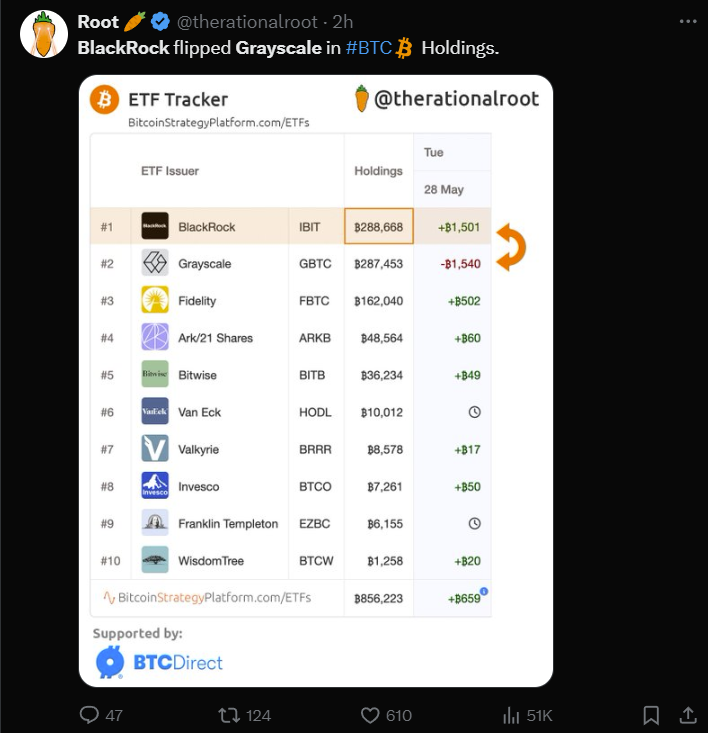

- In related news, on May 28, 2024, BlackRock's IBIT overtook Grayscale's GBTC fund. It took just four months for BlackRock to become the leading Bitcoin ETF issuer.

- BlackRock’s iShares Bitcoin Trust (IBIT) now holds 288670 BTC, while Grayscale Bitcoin Trust ETF (GBTC) is down to 287450 BTC, per HODL15Capital.

- "Grayscale held 620,000 BTC at the time of the conversion (1/10/2024), which was more than 3% of circulating supply, but refused to lower the fee (1.5% vs 0.2% for peers), even after investors pulled 330,000+ BTC. So much for the "differentiated" strategy," commented HODL15Capital on X.