Coin Center's Tornado Cash OFAC Sanctions Lawsuit Dismissed Due to DAO Structure and TORN Shitcoin

"TORN holders still have an indirect beneficial “interest” in the use of the core software tool and the service as a whole because that increases the value of the TORN," stated the judge.

- Coin Center claimed that the addresses associated with the core non-upgradeable smart contracts that made up Tornado Cash weren’t appropriate targets for the sanctions.

- As in previous cases against Tornado Cash, both the existence of a decentralized autonomous organization (DAO) and its governance token TORN have been viewed by the judge as sufficient evidence to establish the precedent for a sanctionable entity.

“TORN owners and the DAO are … similar to stockholders, who have an interest in the enterprise, and may benefit from the success of TORNADO CASH [because] the more users that submit virtual currency to the smart contracts to be mixed, the larger the pool becomes, and the more effective the virtual currency may be mixed, thereby increasing the value of TORNADO CASH and of TORN tokens”)," reads the court decision.

- "The indirect interest that TORN holders (including the Tornado Cash founders, developers, and DAO) have in the increased use and popularity of the Tornado Cash service as a whole is sufficient to establish that foreigners have an “interest” in the core software tool."

"The fact that TORN had substantial value before relayers (and the fees they paid) were added to the Tornado Cash service in March 2022 suggests that the service has intrinsic value even without relayers and supports the inference that increased use of the service will increase the value of the TORN held by Tornado Cash’s founders, developers, and DAO."

- The court also rejected the notion that there was First Amendment protection for Tornado Cash, stating that "the designation of Tornado Cash does not preclude Plaintiffs…from spending money or donating money for political ends, nor does it preclude organizations from accepting anonymous donations."

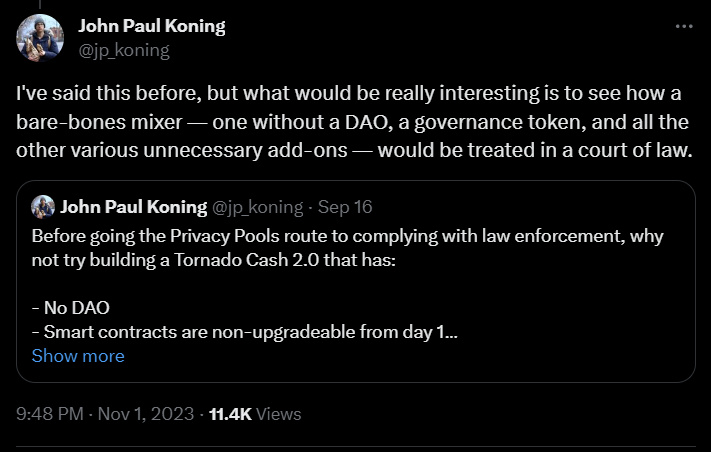

- "Out of the 91 addresses that OFAC sanctioned, Coin Center only challenged 29 of them, specifically those which make up the "core software tool." These were Tornado Cash's non-upgradeable contracts," highlighted John Paul Koning.

- Coin Center's Neeraj K. Agrawal said that Coin Center will appeal the court's decision.

- Related Coinbase-backed lawsuit arguing that U.S. Treasury Department overstepped its authority in sanctioning Tornado Cash has been dismissed using similar reasoning in August.