Coin Center's Post-Election Policy Outlook: Positive for Securities & Banking; Uncertain on Surveillance Issues

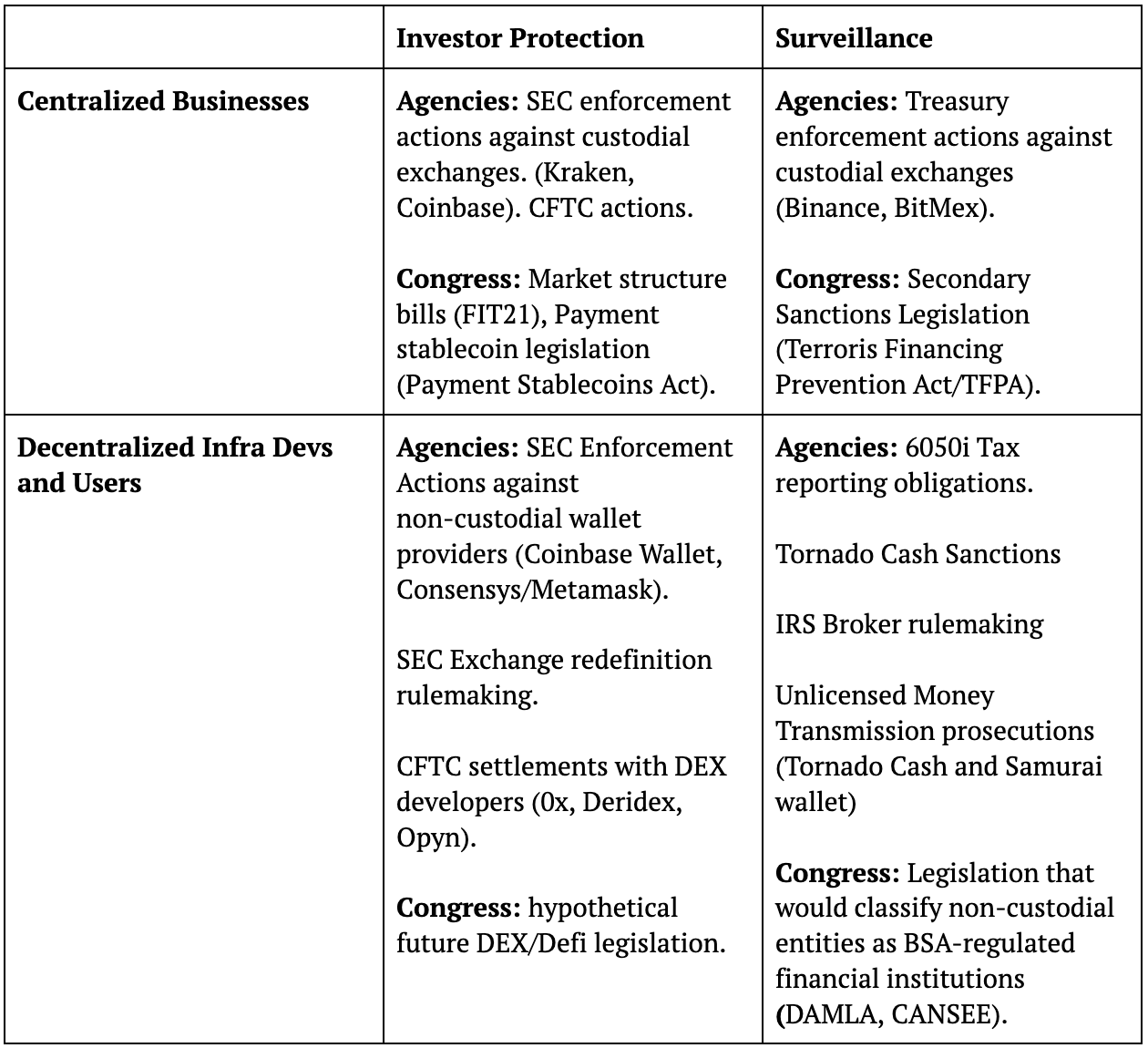

Coin Center anticipates good policy in areas of securities and banking regulation, while "the outlook is less certain in the anti-money laundering, tax reporting, and sanctions areas."

- In its latest analysis of the changing cryptocurrency policy landscape, Coin Center, a non-profit focused on Bitcoin and digital asset policy issues, said it expects positive developments in policies concerning investor protection. However, areas concerning surveillance issues might remain more challenging.

"Coin Center will remain focused on protecting the rights of developers who are working on software for self custody and privacy as well as the rights of ordinary Americans who want to use those tools," said the organization.

- The research and advocacy group stressed that it aims for good policy on all dimensions, but its core mission remains protecting the rights of developers and users of decentralized peer-to-peer protocols.

"Coin Center’s mission is focused on decentralized infrastructure developers’ right to publish code (First Amendment issues) and on stopping unwarranted surveillance obligations (Fourth Amendment issues), and that fourth quadrant box is the overlapping battleground for both topics."

When it comes to the biggest threats, Coin Center outlined the following issues:

- 6050I reporting obligations that mandate businesses to file reports (including names and Social Security numbers) about their counterparties whenever they receive more than $10,000 in cryptocurrencies.

- Tornado Cash sanctions that prohibit Americans from using tools like immutable smart contracts, that are neither foreign persons nor their property.

- Unlicensed money transmission prosecutions against the developers of non-custodial software tools such as Tornado Cash and Samourai Wallet.

"The DOJ may change under a Trump administration, but it rightly guards its political independence and may therefore be unlikely to abandon these prosecutions because of a change in administration," states the analysis.

- The organization noted that it remains hopeful and is looking forward to progress on these pressing issues "if it becomes increasingly clear that even with a friendlier SEC, draconian surveillance and control policies will continue to drive innovators away from the US, chill development, and deny ordinary Americans the benefits of these technologies (all the while doing very little to actually prevent criminals and terrorists from using them)."

"It’s up to us to make it clear that being “pro-crypto” doesn’t just mean choosing friendlier agency heads or implementing pro-business regulations, it also means something deeply American: standing up for privacy and speech when it’s hardest to do so, when the national security stakes are high and the specters of crime and terrorism ever so briefly appear to eclipse our lasting virtues of liberty, privacy, and openness," said Peter Van Valkenburgh, Director of Research at Coin Center.