ECB Economists: Nocoiners May Be Impoverished by Rising Bitcoin Prices

A new paper by ECB economists describes a 'Bitcoin-positive' scenario as one in which the price of Bitcoin continues to rise significantly and sustainably over time.

- European Central Bank Director General Ulrich Bindseil and advisor Jürgen Schaaf, known for classic ECB blog posts such as 'Bitcoin’s last stand' and 'ETF approval for bitcoin – the naked emperor’s new clothes,' published a new paper titled 'The distributional consequences of Bitcoin.'

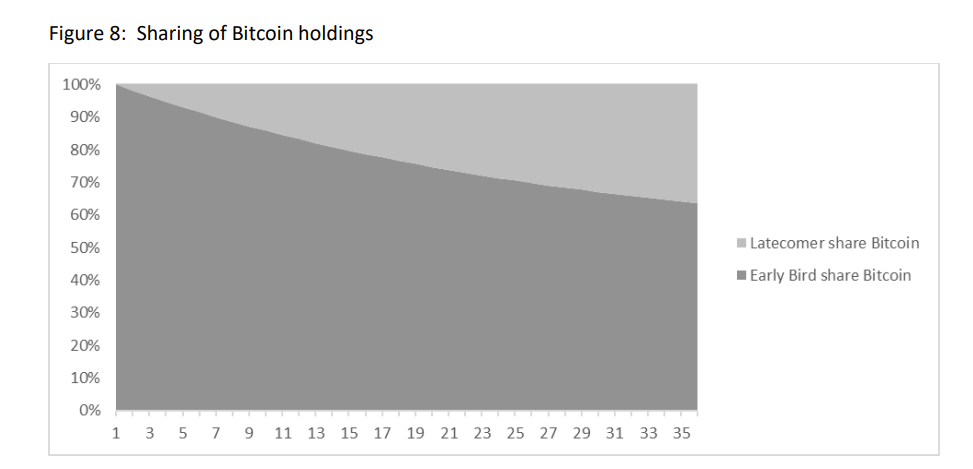

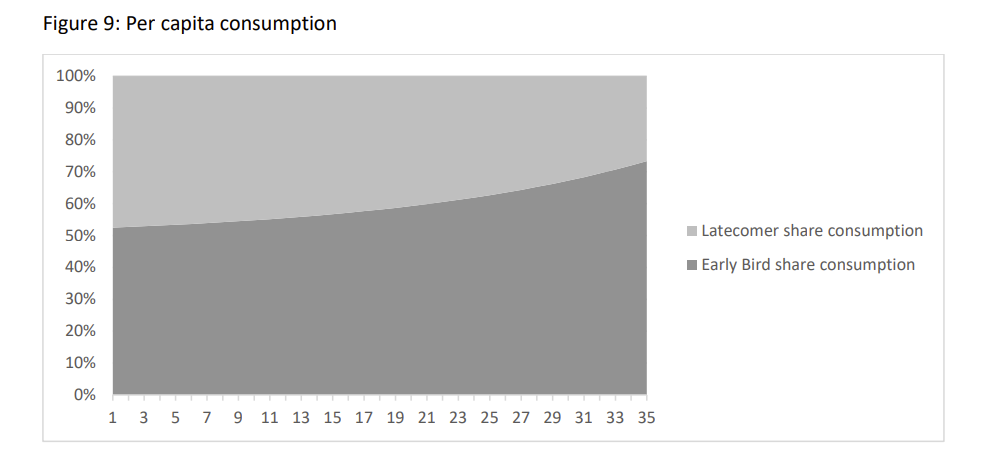

- The paper explores the macroeconomic consequences of a prolonged increase in Bitcoin prices. It suggests that such increases would lead to wealth effects favoring early holders at the expense of non-holders and latecomers.

"Since Bitcoin does not increase the productive potential of the economy, the consequences of the assumed continued increase in value are essentially redistributive, i.e. the wealth effects on consumption of early Bitcoin holders can only come at the expense of consumption of the rest of society. If the price of Bitcoin rises for good, the existence of Bitcoin impoverishes both non-holders and latecomers," write the economists.

- The authors also argue that Bitcoin's initial promise as a global means of payment has not been realized. Instead, it has become primarily viewed as an investment vehicle, potentially leading to significant wealth redistribution effects.

- "Promoters of this investment vision put little effort relating Bitcoin to an economic function which would justify its valuation," write the economists. "Larry Fink, Cathie Wood, Marty Bent, and many other prominent figures share a common view on Bitcoin as a pure investment asset and growing future valuations decoupled from economic services Bitcoin could potentially deliver to society."

- The paper concludes that viewing Bitcoin purely as an investment with perpetually rising prices poses risks for societal equity and even democratic stability.

"Current nonholders should realize that they have compelling reasons to oppose Bitcoin and advocate for legislation against it, aiming to prevent Bitcoin prices from rising or to see Bitcoin disappear altogether. Latecomers and non-holders and their political representatives should emphasize that the idea of Bitcoin as an investment relies on redistribution at their expense," conclude the economists.