EU Parliament Passes FATFs Travel Rule & MiCA Licensing Regulations

The legislation defines categories, registration and disclosure requirements for crypto projects and provides a strict AML framework and compliance requirements for custodial institutions and services. Non-custodial wallets and services as well as regular wallets are exempt.

- Lawmakers in the European Union also voted 529-29 in favor of the Transfer of Funds regulation, EU's interpretation of FATF's Travel Rule, which requires service operators to identify their customers and counterparties in a bid to halt money laundering.

- The European Parliament voted 517-38 in favor of a new crypto licensing regime called Markets in Crypto Assets (MiCA). The bill defines terminology and scope of regulations to align EU legislation with the FATF’s Recommendations.

"I welcome the European Parliament’s vote today to approve comprehensive EU rules on crypto: a world first. We’re protecting consumers and safeguarding financial stability and market integrity," said EU's Commissioner of Financial Services Mairead McGuinness.

Transfer of Funds Regulation (Travel Rule)

- The Transfer of Funds Regulation (TRF) is the European Union's implementation of the Travel Rule.

- "Designed to be applied together and in accordance with the Markets in Crypto Assets ( Regulation, the TFR applies to CASPs as defined by MiCA Article 3(1), point (15):"

- Third-party-based custody and administration of crypto assets

- Operation of a trading platform for crypto assets

- Exchange of crypto assets for fiat currency

- Exchange of crypto assets for other crypto assets

- Execution of orders for crypto assets on behalf of third parties

- The placing of crypto assets

- Reception and transmission of orders for crypto assets on behalf of third parties

- Providing advice on crypto assets - Transaction threshold: 0 EUR. "Every crypto asset transfer between obliged entities must fulfil the TFR’s data collection, storage and exchange obligations with the counterparty."

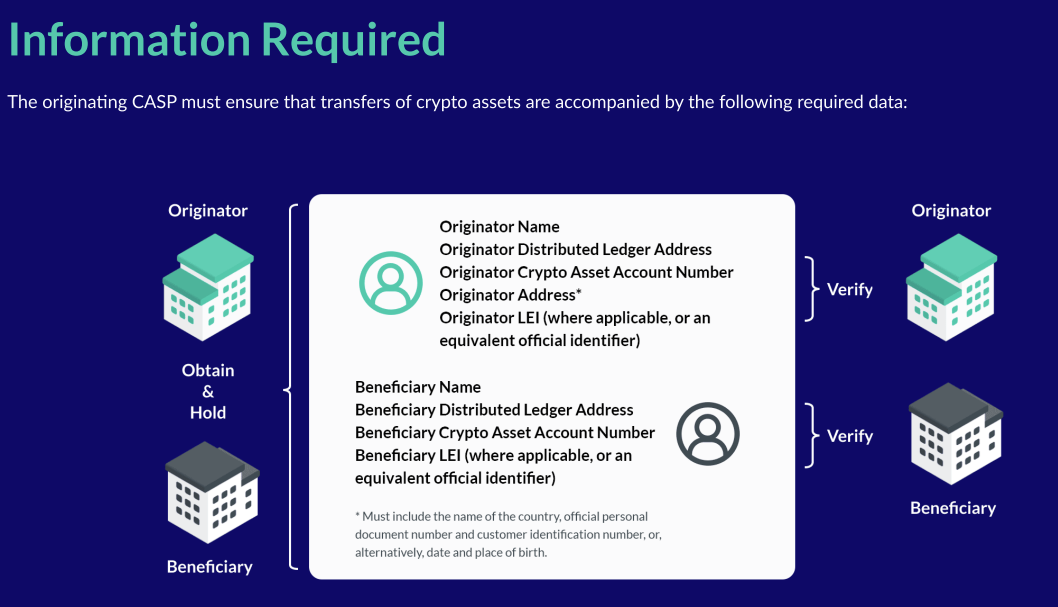

- "CASPs must guarantee, through established effective procedures, that the information required by the TFR is not missing or incomplete."

- Know-Your-Counterparty: "CASPs must perform Enhanced Due Diligence ( ) to assess and identify risks, similar to that applied in the context of banking when establishing a new relationship with another CASP, specifically the ones outside the European Union."

- Regular wallets are not obliged entities. Therefore, peer-to-peer (P2P) transactions (from a regular wallet to a regular wallet) are not in scope.

- "In the case of a transfer to or from a "self-hosted address" [regular address], the CASP should collect, usually from its client, and hold, but not verify, the information on both the originator and the beneficiary. The CASP must also ensure that the transfer can be individually identified."

- The rule is expected to be implemented within the European Union within the next 18 months (by 2025).

Transfer of Funds Rule Visual Summary (via 21 Analytics)

Bill Text

Markets in Cryptoassets (MiCA)

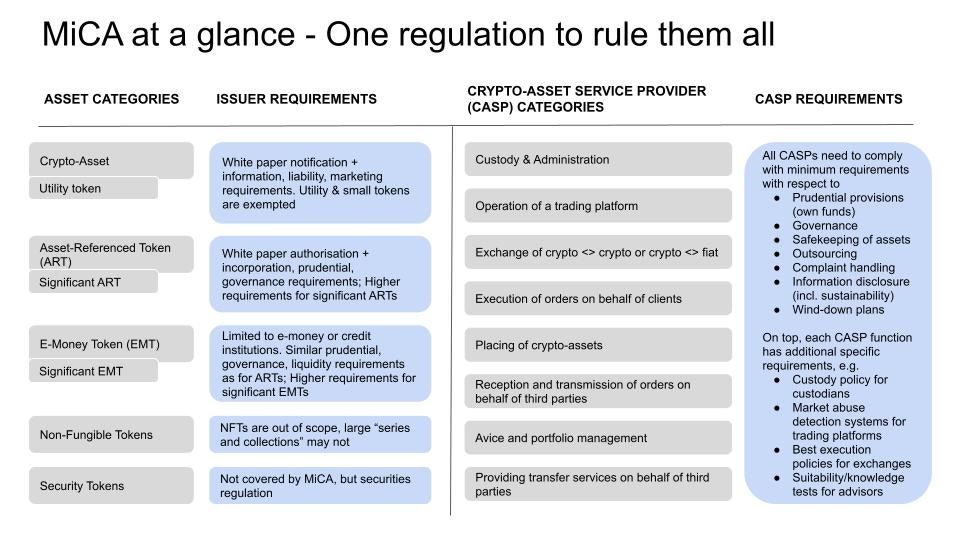

- "The Markets in Cryptoassets (MiCA) Regulation is the EU regulation governing issuance and provision of services related to cryptoassets and stablecoins."

- "MiCA establishes mechanisms to ensure that stablecoins are truly stable, require enhanced transparency in the market, and prevent players from creating excessive risk, while making sure that the assets under custody are genuinely protected."

- "MiCA defines a crypto-asset as “a digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology.” The Regulation draws a distinction between ‘cryptocurrencies’ on one hand and 'tokens' on the other."

- "Cryptoasset issuers must provide complete and transparent information about the cryptoassets they issue, and comply with disclosure and transparency rules. Cryptoasset service providers must be registered and implement security measures and anti-money laundering compliance."

- "MiCa excludes new paradigms such as the DeFi (Decentralized Finance) industry and non-fungible tokens (NFT)."

- MiCA will enter into force at some point between mid-2024 and early 2025.