Prices Slump Amid FTX Solvency Concerns: Binance Goes For Kill Shot

CZ and Binance appear to have taken this action due to recent regulatory lobbying efforts that SBF and FTX have made to the US Government, including lobbying against Binance behind their back.

- Last week, Coindesk reported that much of Alameda Research's $14.6B in assets were FTT used as collateral for loans against it.

- Alameda Research is Sam Bankman-Fried's trading arm.

- SBF also owns FTX, his exchange, and FTT is the FTX exchange token.

- With this report came speculation that a decline in the price of FTT token would cause solvency issues at both Alameda and FTX.

- Taking advantage of the concerns around a potential competitor, Binance announced that they would be dumping a massive amount of FTT on the market.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

- CZ and Binance appear to have taken this action due to recent regulatory lobbying efforts that SBF and FTX have made to the US Government, including lobbying against Binance behind their back.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

- Alameda appears to be selling all other liquid assets they hold to defend the price of FTT, crashing prices across all cryptocurrencies, including bitcoin.

- This attempt appears to be futile as the FTT Token is now down nearly 27% over the last 24 hours as Binance and other market participants dump their tokens.

- One last interesting item to point out here, the feud between CZ and SBF seems to go back over three years, when Alameda was executing aggressive trading against Binance users.

A market maker from a smaller futures exchange tried to attack @binance futures platform. NO ONE was liquidated, as we use the index price (not futures prices) for liquidations (our innovation). Only the attacker lost a bunch of money, and that was that. pic.twitter.com/ztMZEtYKc6

— CZ 🔶 Binance (@cz_binance) September 16, 2019

- SBF's last tweet was over 24 hours ago when he said there should be no cause for concern over FTX's solvency. His lack of recent updates and the crashing price of FTT says otherwise.

1) A competitor is trying to go after us with false rumors.

— SBF (@SBF_FTX) November 7, 2022

FTX is fine. Assets are fine.

Details:

- This is becoming another expensive example of the risks of leverage and trusting custodians to hold your money.

- As this unwinds it could cause collateral damage throughout much of the industry due to FTX's deep relationships with other companies and trading firms.

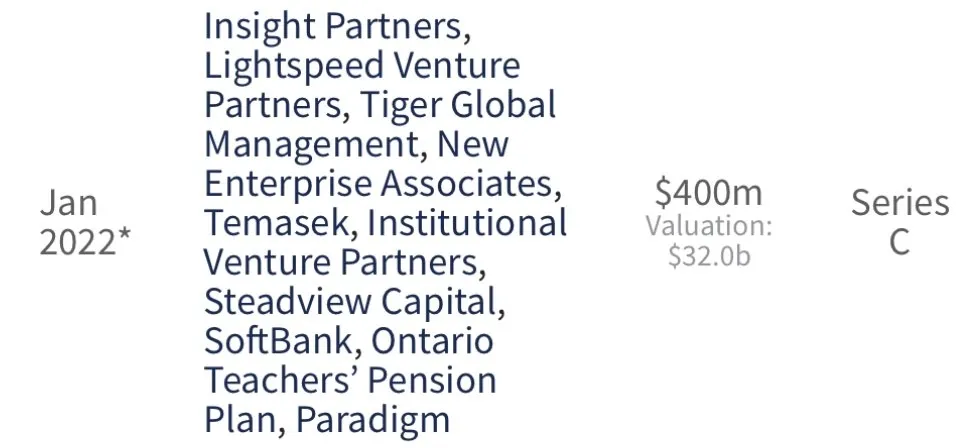

- FTX was last valued at $32B with investors including the Ontario Teachers' Pension Plan.

- Update Nov 8 15:34 UTC: FTX Withdrawals Appear to be Frozen

- Update Nov 8 16:18 UTC: Binance Announces Intent to Buy FTX After Causing Solvency Issues

- Update Nov 9 16:15 UTC: Binance releases employee memo publicly

- Update Nov 9 17:45 UTC: Most of FTX’s legal and compliance staff have quit

- Update Nov 9 21:14 UTC: Binance Announces They Will Not Acquire FTX

- Update Nov 10 17:50 UTC: FTX Appears to Be Processing Withdrawals Again Based on Chain Data: Nearly $7M Withdrawn

- Update Nov 11: BlockFi Halts Withdrawals: Appears Insolvent as FTX Contagion Spreads

- Update Nov 11: As FTX Contagion Spreads, More Custodians Expected to be at Risk: Withdraw Bitcoin to Self Custody ASAP

- Update Nov 11: FTX Files for Chapter 11 Bankruptcy: Includes FTX US, SBF Steps Down as CEO