Genesis Balance Sheet Reveals $2.8 billion in Outstanding Loans: 30% made to related parties including parent company Digital Currency Group

Silbert noted that DCG has a liability of $575 million to Genesis. In the letter, he also described a $1.1 billion promissory note, due June 2032, which he said came about as the parent company stepped in to assume liabilities from Genesis related to the implosion of Three Arrows Capital.

- The troubled brokerage Genesis Global has $2.8 billion in outstanding loans on its balance sheet, with about 30% of its lending made to related parties including its parent company, Barry Silbert’s Digital Currency Group, according to people familiar with the matter.

- Among them, a lending subsidiary named Genesis Global Capital had been lending money to Genesis Global Trading -- the brokerage unit that has become a key counterparty to institutions across the crypto industry.

- Silbert noted that DCG has a liability of $575 million to Genesis. In the letter, he also described a $1.1 billion promissory note, due June 2032, which he said came about as the parent company stepped in to assume liabilities from Genesis related to the implosion of digital-assets hedge fund Three Arrows Capital.

- Silbert’s Digital Currency Group is the parent company of Genesis and has an interest in more than 200 other firms.

- Genesis is a counterparty to many in the digital-asset space.

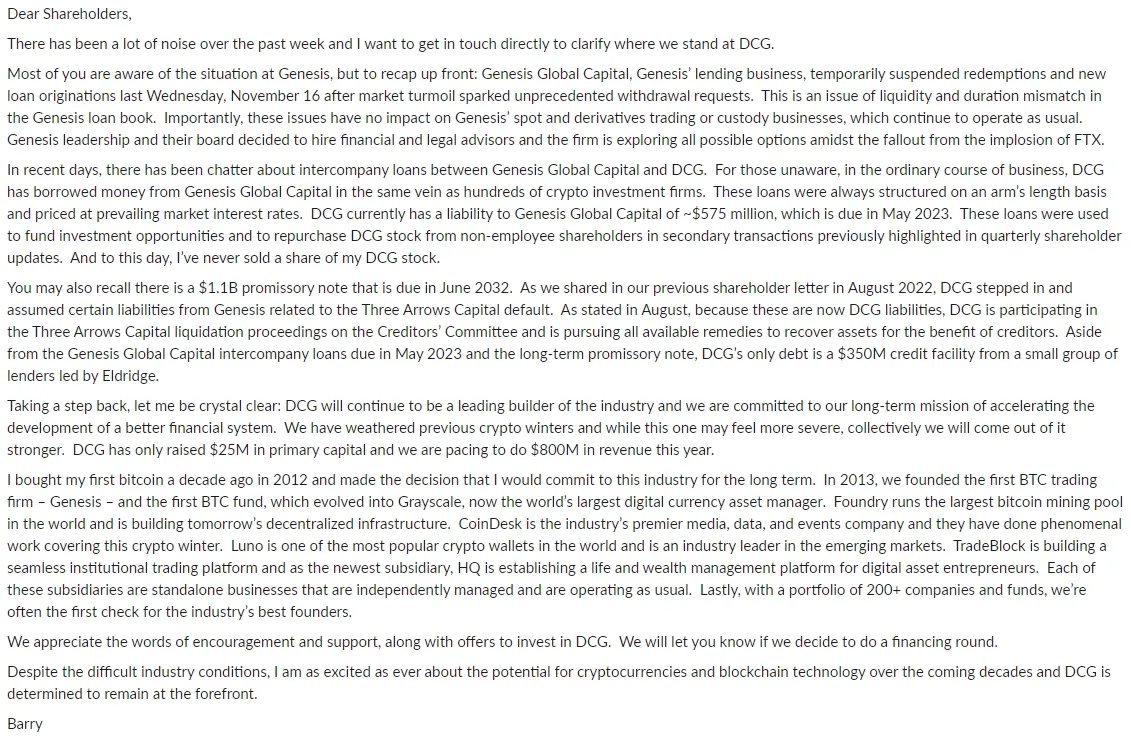

Full DCG Shareholder Letter: