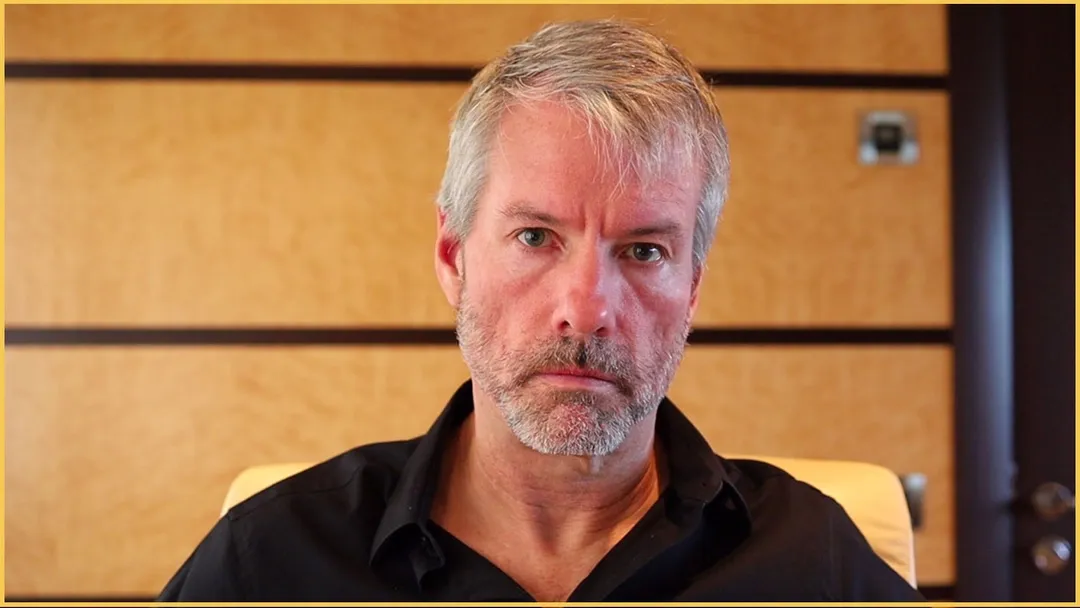

Michael Saylor to Pay a District Record $40M Settlement in D.C. Income Tax Case

MicroStrategy founder and Executive Chairman Michael Saylor agreed to a $40 million settlement with the District of Columbia, according to the attorney general's office.

- This is the largest-ever income tax fraud recovery in the district and the first lawsuit under the amended False Claims Act, which encourages whistle-blowers to report tax evasion.

- Saylor was accused of evading over $25 million in income taxes with the help of his company, MicroStrategy, from 2005 to 2020. The lawsuit stated that Saylor and the company asserted he resided in Virginia or Florida, where income tax rates are considerably lower.

"Florida remains my home today, and I continue to dispute the allegation that I was ever a resident of the District of Columbia. I have agreed to settle this matter to avoid the continued burdens of the litigation on friends, family, and myself," Saylor told The New York Times.