Report: Bitcoin vs the $156 Trillion Global Payments Industry

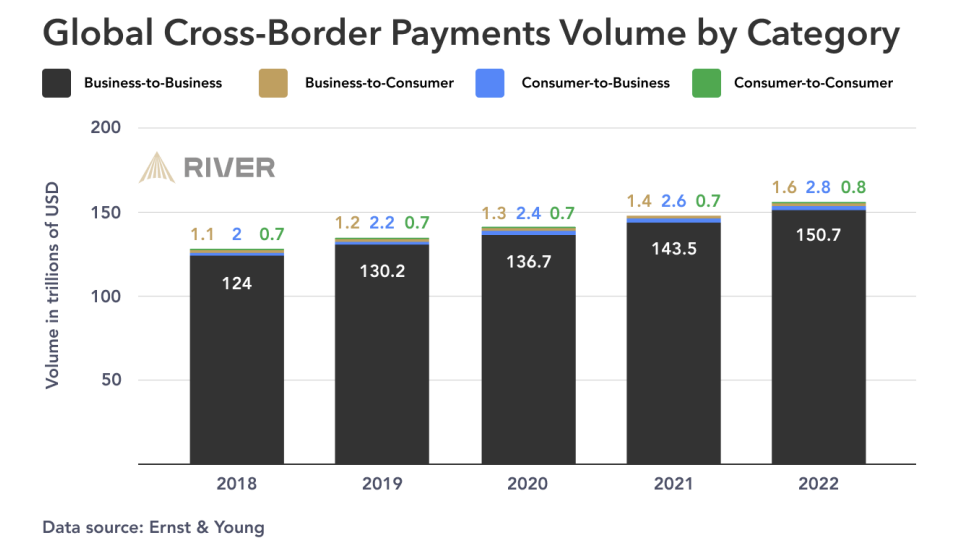

River's new research report explores the adoption of Bitcoin in the context of the $156 trillion global payments industry.

Key findings on the Cross-Border Payments Industry

- "The cross-border payments industry is growing quickly and consistently, but there is a lack of incentives for incumbents in all segments to significantly improve the underlying payments infrastructure."

- "96.7% of cross-border payments are B2B according to EY, at $150.7 trillion in 2022. Other research institutions provide conflicting data on this opaque industry."

- "78.8% of remittances, or $626 billion in 2022, went to low- and middle-income regions."

- "85% of the world population can instantly send and receive data through their smartphones, but money transfers are measured in days and cost 6.24% on average for remittances. Theoretically, this could drop to 3.31% if all consumers were fully aware of their options."

- "Worldwide adult ownership of financial accounts has risen from 51% in 2011 to 76% in 2021 according to The Global Findex Database 2021, and an estimated 10% of the global population does not have a government-issued ID to open an account."

- "Innovation in cross-border payments is currently focused on two main initiatives: 1) The international linking of national instant payment systems and 2) The introduction of Central Bank Digital Currencies CBDCs)."

"For CBDCs, there is little consideration within the industry for the immense danger they represent in the hands of oppressive regimes to target, punish, tax, and financially control specific parts of the population. 70% of the global population lives in such authoritarian regimes according to Our World in Data. There is no legislation and there are no features that would prevent CBDCs from being used to enforce government policies."

Key Findings on Global Bitcoin Adoption

- "There are roughly 800k active Bitcoin addresses per day, but this is not an accurate representation of the number of daily users due to how Bitcoin works technically."

- "There are an estimated 32.9 million active entities in Bitcoin, and roughly 44.4 million addresses with usable balances according to Glassnode."

- "There is roughly 2.34 million bitcoin stored on 20 major exchanges as of June 2023." 500k is held on Coinbase, and 630k BTC is held on Binance.

- "We estimate a range of 48.8 - 97.5 million bitcoin holders on all exchanges globally."

"An estimated 70% of users hold bitcoin on exchanges and 80% in mobile or desktop wallets, so there is a significant overlap between the 32.9 million active entities and exchange users."

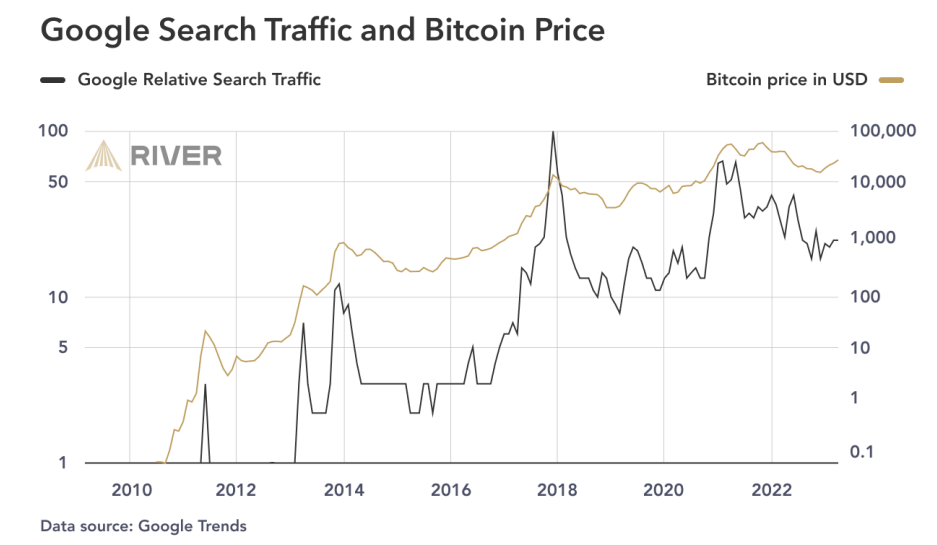

- "Relative Google search traffic for Bitcoin from 20132023 was highest in Nigeria and El Salvador, in which the average search query is almost twice as likely to be about Bitcoin than in the next countries of Austria, The Netherlands, and Switzerland."

- "The number of people sending remittances globally (200 million) is potentially at least 100-400% higher than the number of Bitcoin holders."

Key findings on Cross-Border Payments with Bitcoin

- "Bitcoin B2B cross-border payments adoption remains limited today. B2B is typically the last to adopt new technologies. The effort to not only integrate the technology but also educate many stakeholders is perceived as a hurdle."

- "89% of consumers do not engage in payments and hold their bitcoin to make a profit. U.S. consumers are discouraged from spending bitcoin through taxation rules that turn transactions into taxable events."

- "El Salvador’s central bank reported that from January to May 2022, Chivo Wallet processed $52 million in remittances or 1.6% of its total estimated volume of $3.175 billion. This number is relatively high, given how new Bitcoin is to many people."

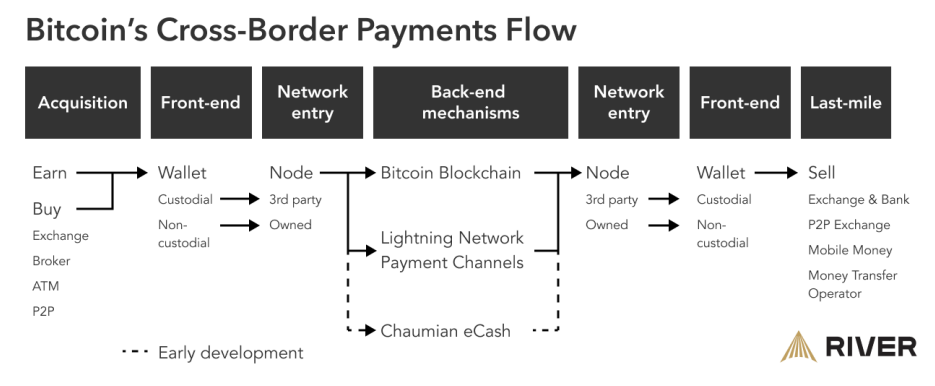

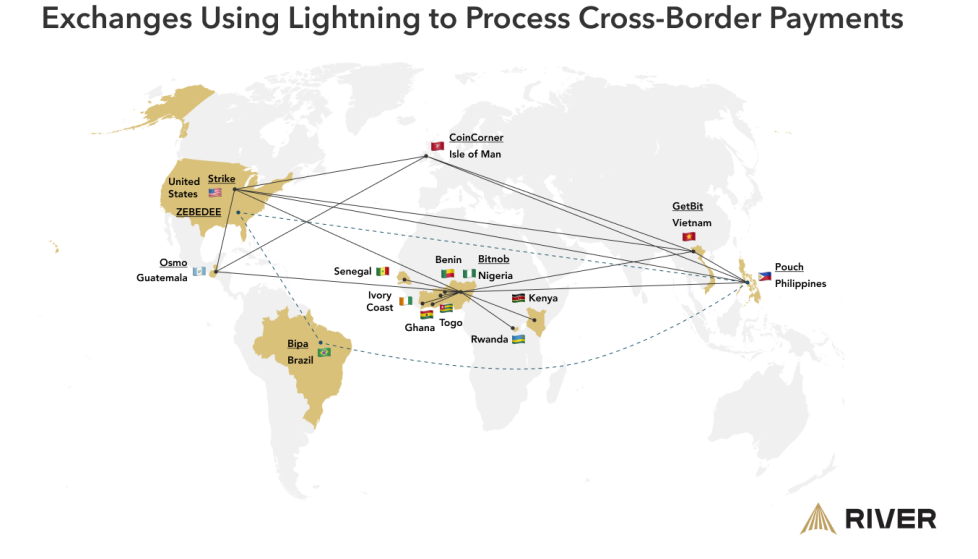

- "Since late 2022, six businesses across five continents have started building out payment networks using Lightning as back-end infrastructure as described on the previous page. We expect more institutions to join them in the coming years."

Key findings on Growing Bitcoin CBP Adoption

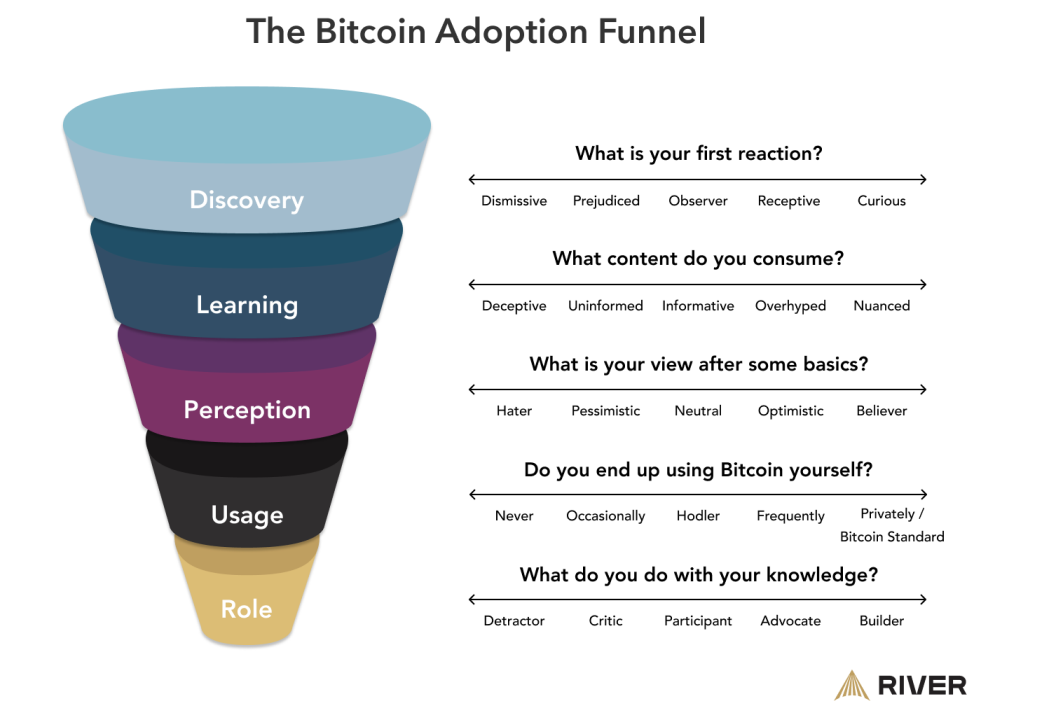

- "Bitcoin advocates have a lot of work and introspection to do if they want to educate people who are thus far not interested in Bitcoin.

- Explain Bitcoin in ways that resonate with the specific listener rather than a generalized or personal perspective.

- Develop additional learning experiences to articles, books, and podcasts.

- Focus on people who already understand that fiat currency is broken:

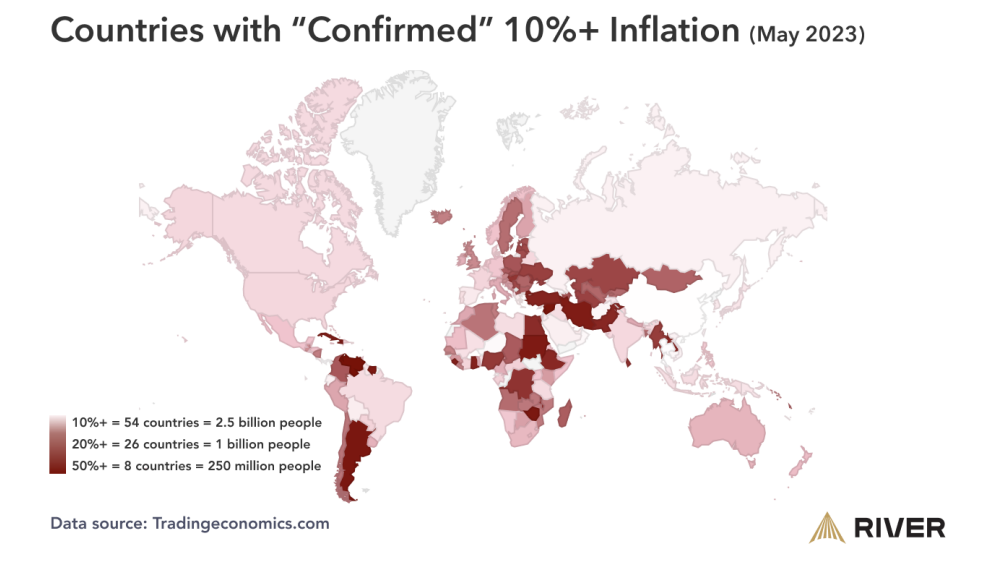

■ 2.5 billion people in 54 countries live with double-digit inflation.

■ Countries that heavily rely on remittances.

■ Countries with capital controls and black markets for currency."