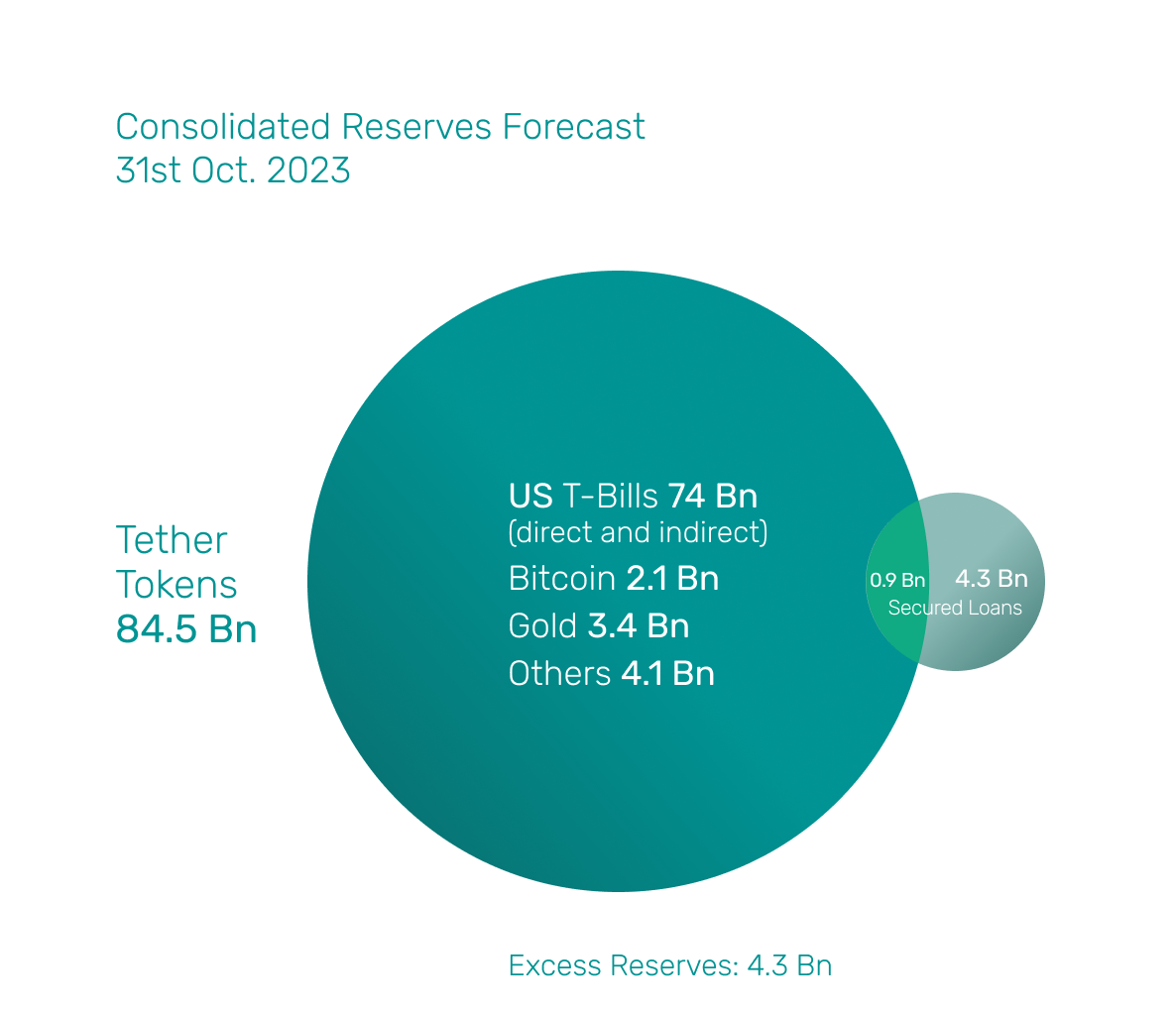

Tether Q3 Attestation Show Highest Percentage of Cash & Cash Equivalent Reserves Yielding Close to ~$1Bn

Tether Q3 attestation reveals highest percentage of Cash & Cash Equivalent reserves, over $330M reduction in secured loans and $72.6Bn exposure in US T-Bills.

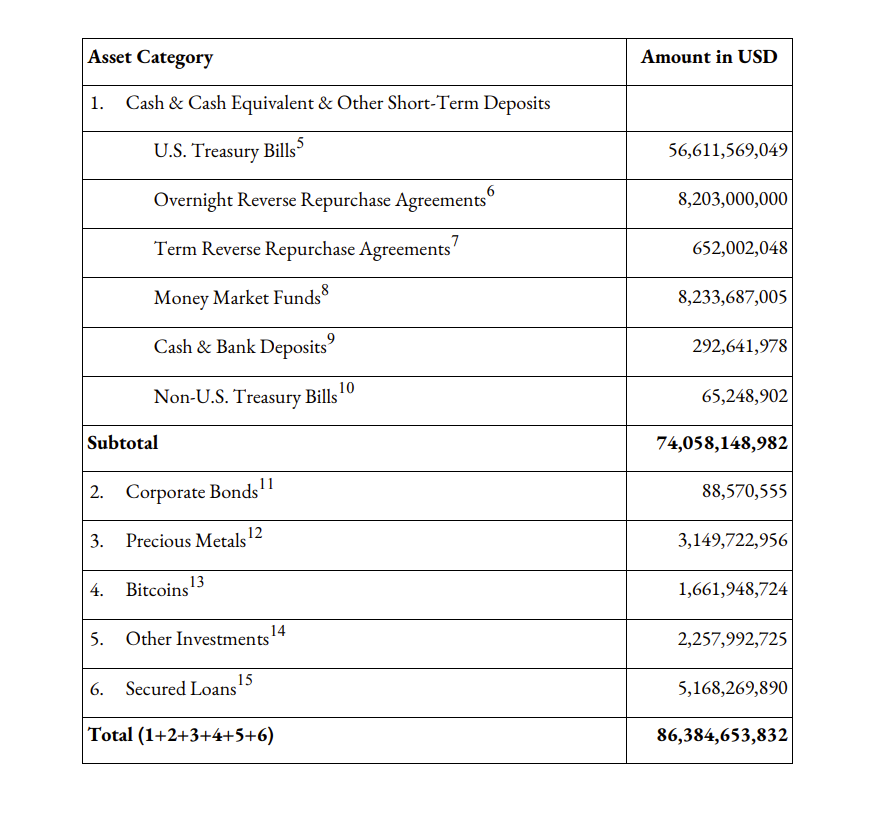

- "The CRR presents Tether's latest update on its reserves revealing a notable milestone, with the highest percentage ever recorded of its reserves held in Cash and Cash Equivalents (C&Ceq), standing at an impressive 85.7%, of which the vast majority are US T-Bills accounting for US$ 72.6 billion comprising both direct and indirect exposure."

- "Furthermore, the report highlights a substantial reduction in the amount of secured loans extended by Tether, with over $ 330 million dollars."

"In a continuation of Tether's public commitment towards openness, Tether disclosed that, by leveraging its robust risk management strategies, and its capacity to weather market volatility, quarterly returns from Cash and Cash Equivalent investments are once again at close to US $ 1 billion."

- "Tether also disclosed the investments made in industry-related research fields for a total amount of over $ 800 million since the beginning of the year (almost US$ 670 million this quarter). These investments are not considered part of the reserves backing the issued token."

The Management of the Company asserts the following as of 30 September 2023:

- Per Kevin Rooke, this also means that Tether increased its Bitcoin holdings to approximately 61606 BTC, up from 54987 BTC in Q2.

You can read the latest assurance opinion and the Consolidated Reserves Report here.