The Emerging Bitcoin-Native Venture Capital Landscape 2022 - Report

Trammel Venture Partners (TVP) announced a first-of-its-kind research brief on the emergence of Bitcoin-native startups as a growth category in venture capital.

- "This research brief represents two years of data and subsequent analysis of the Bitcoin ecosystem, which during 2021 and 2022 has seen significant growth as a startup investment category."

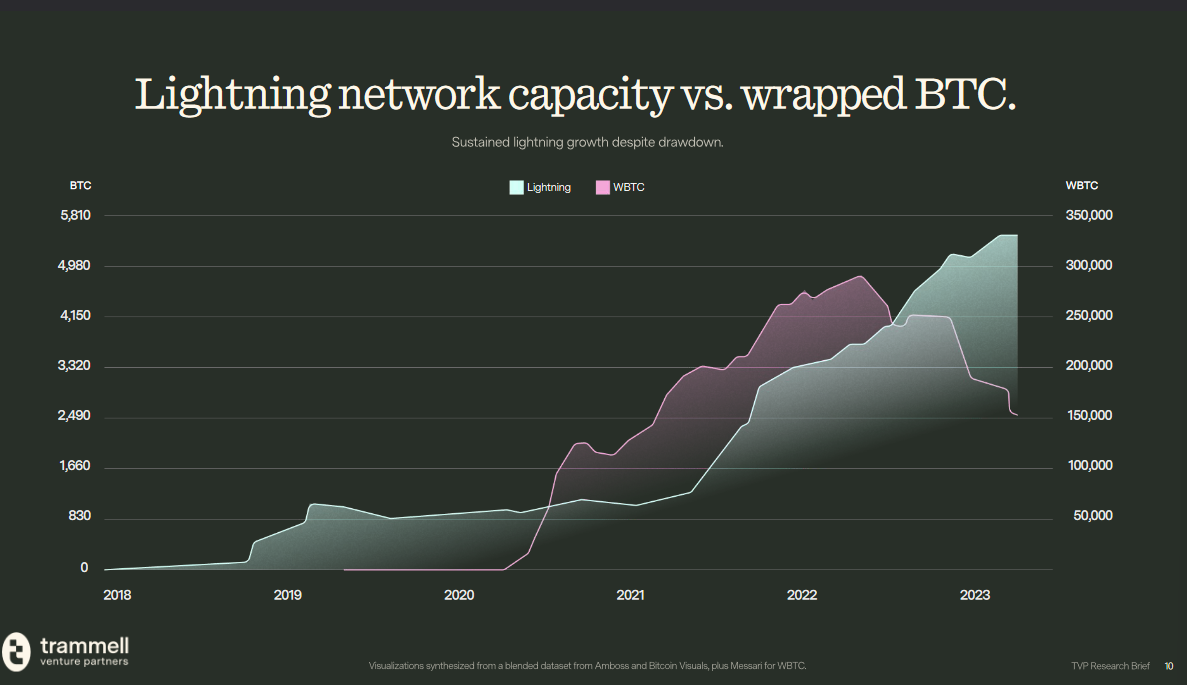

- "With the emergence of the Lightning Network and other tech enablements, Bitcoin is becoming a platform giving greater design space and lower platform risk to entrepreneurs who seek a long-term place to build on a truly decentralized foundation."

- "Near term there are a number of technical possibilities that will further accelerate the Bitcoin-native startup ecosystem."

Report findings include:

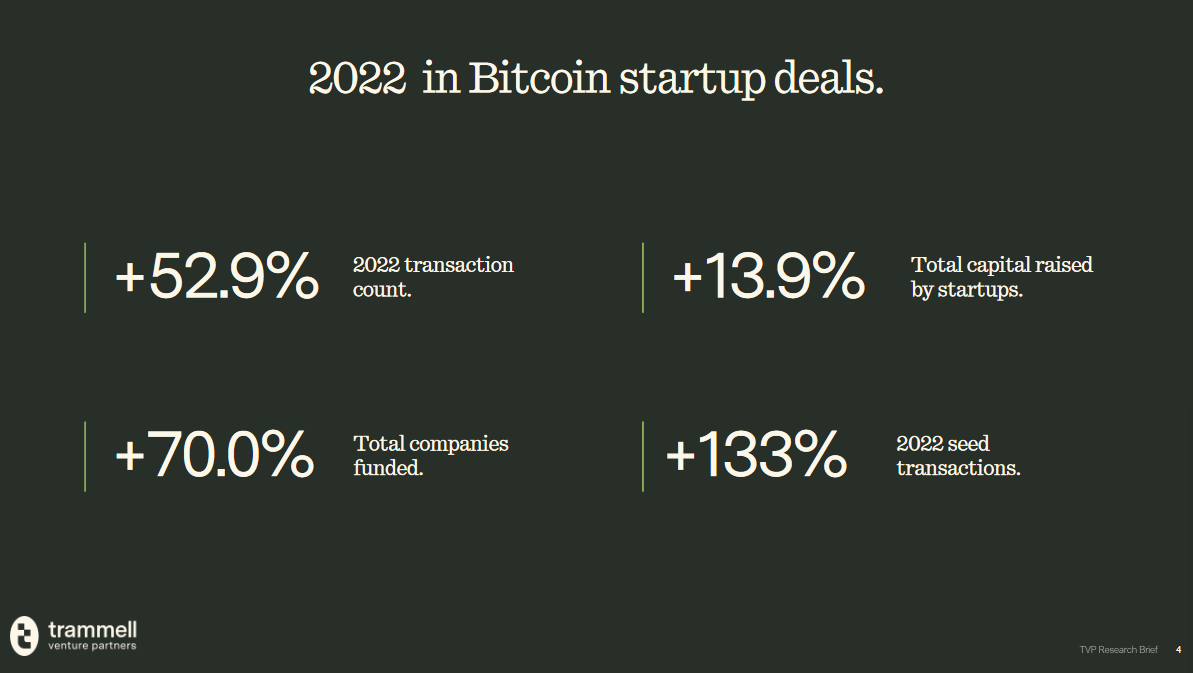

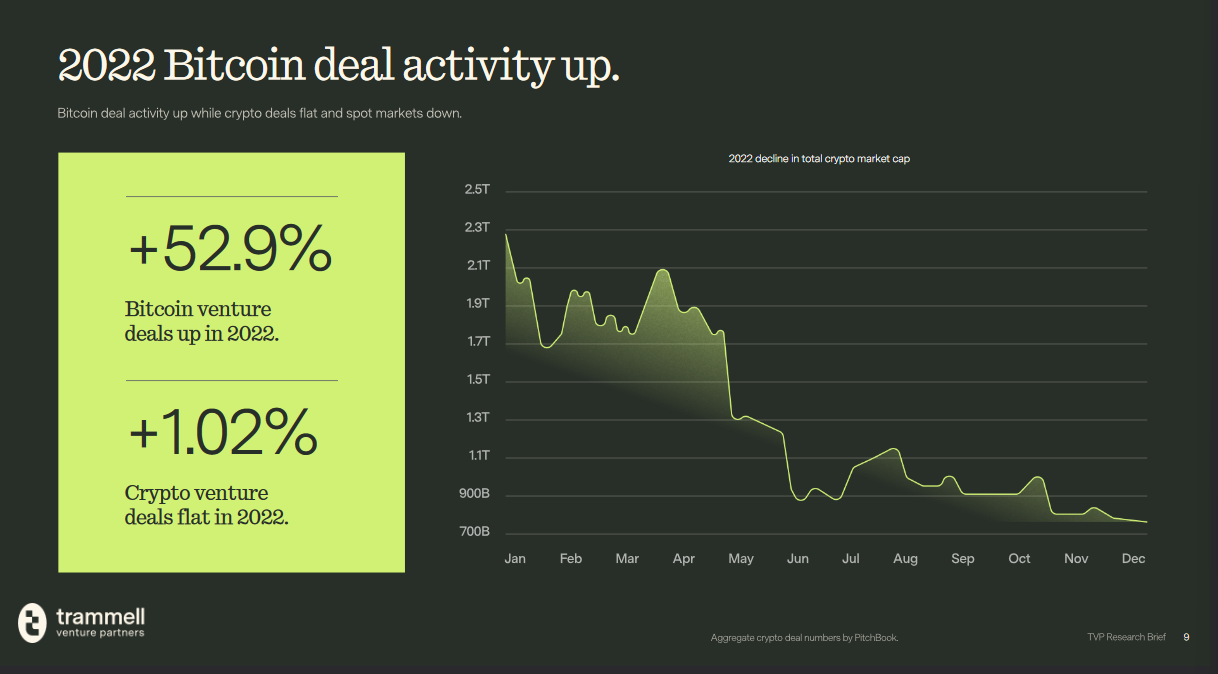

- Bitcoin startup transaction count has gone up between 2021 and 2022.

- This includes total capital raised, growing number of funding rounds as well as unique companies - despite the bear market and tightening macro conditions.

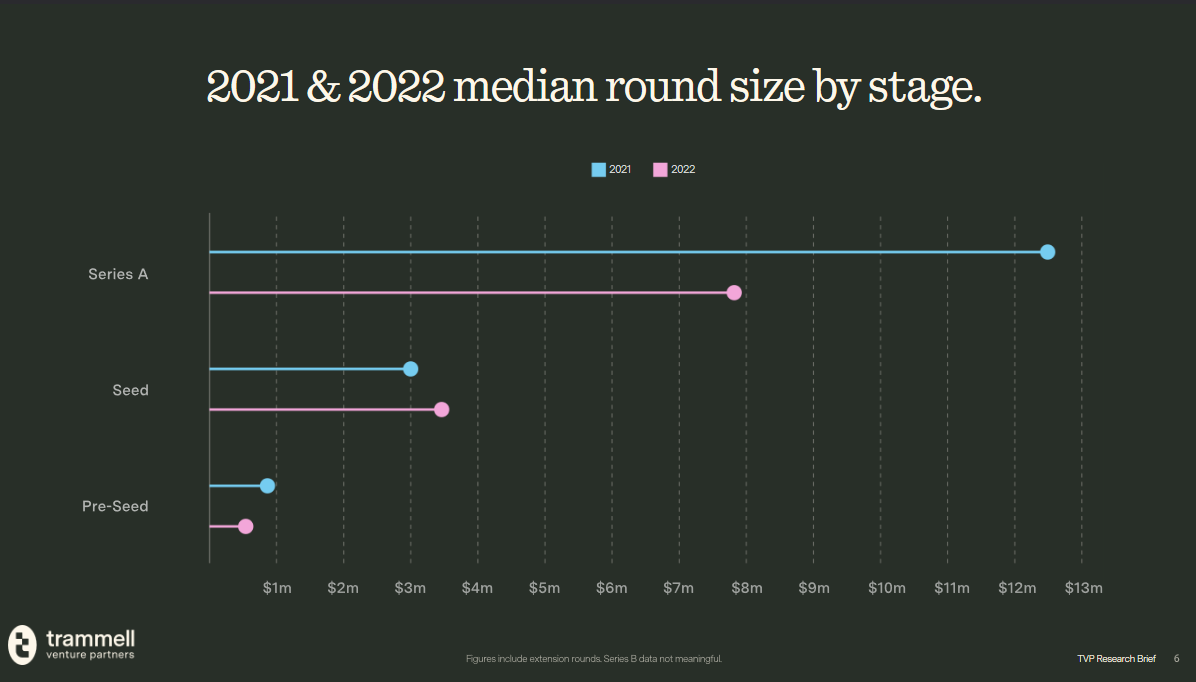

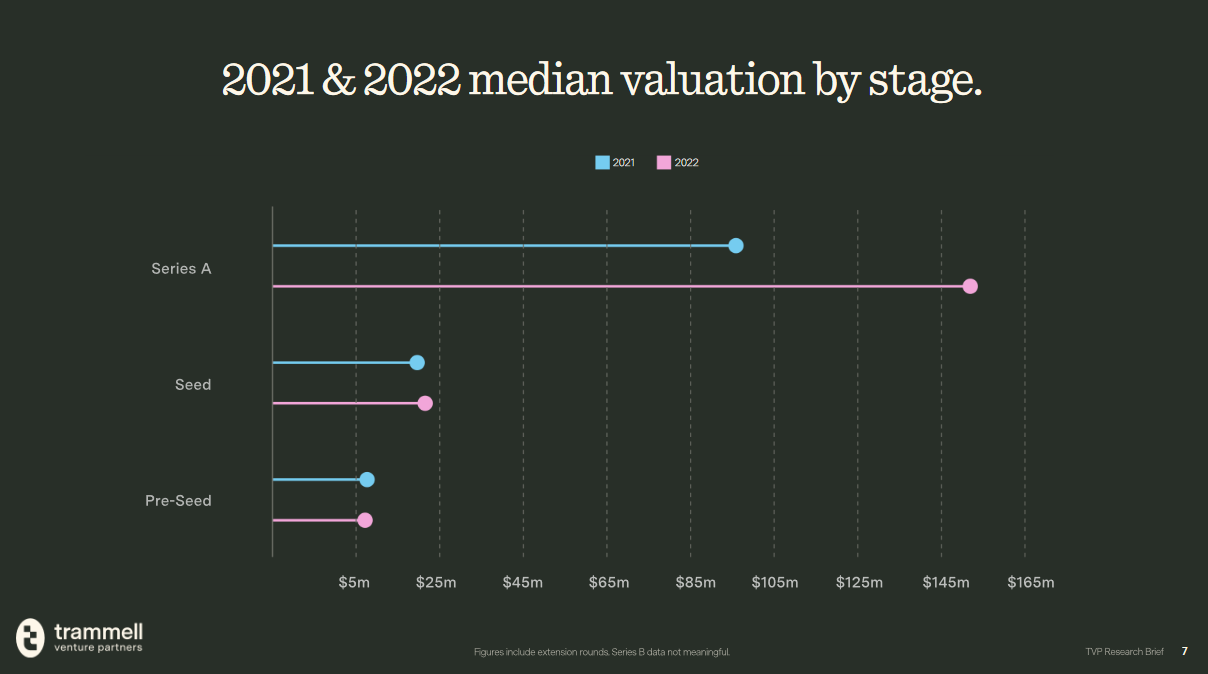

- Here's an overview of 2021 and 2022 Bitcoin company deal sizes and valuations by stage.

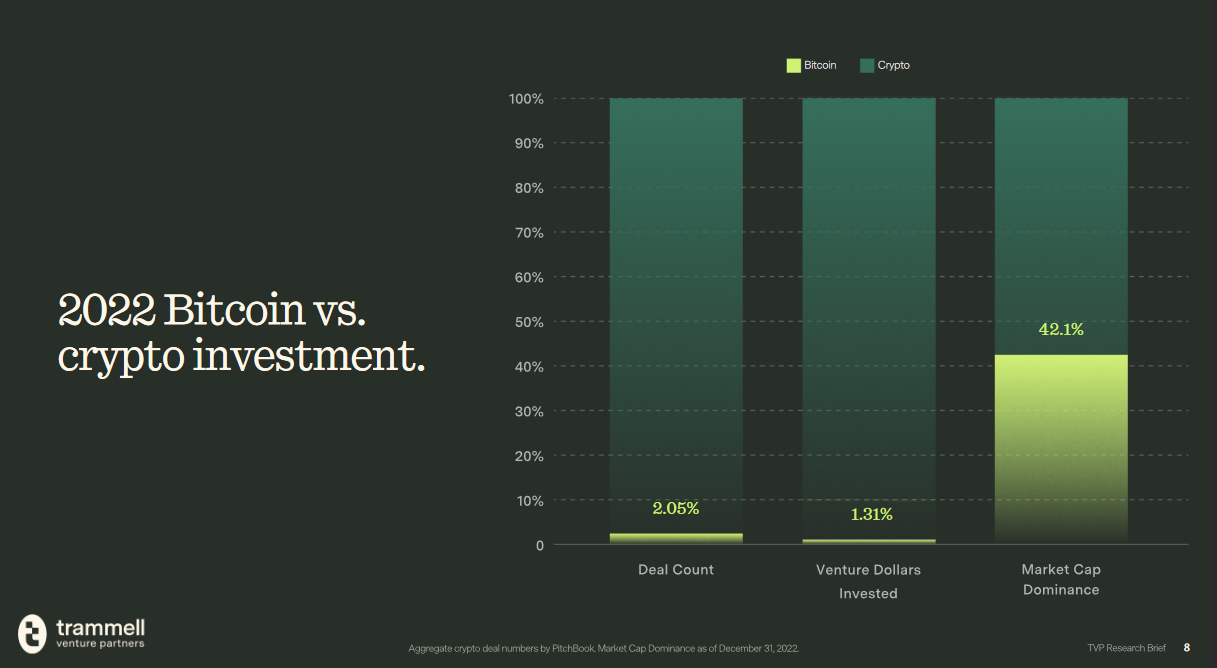

- Deal count and dollars invested in Bitcoin companies versus broader crypto - Bitcoin projects received less than 98% of all the venture deals compared with crypto projects despite maintaining the market cap dominance.

- "Despite the decline in total crypto market cap, bitcoin-native startups emerged as a venture growth category, with deal count growing 52.9% year-over-year."

- The findings are also consistent with the consistent growth of the Lightning network capacity while there is a significant drawdown in BTC on crypto rails.

- The report concludes that there is "a severe misallocation of capital for companies building a sustainable monetary order for the Internet Age."