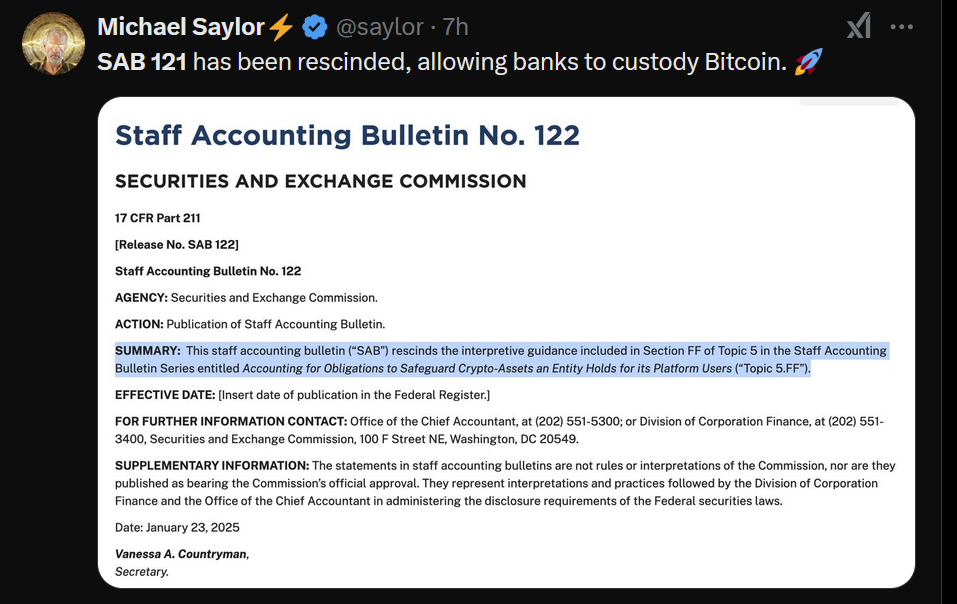

US SEC Withdraws Controversial Accounting Guidance SAB 121 Days After Gary Gensler Leaves

The SEC issued Staff Accounting Bulletin (SAB) 122, which revokes the contentious SAB 121, and permits financial institutions that hold bitcoin and other digital assets for their customers to decide if the held digital assets should be reported as a liability.

- The SAB 122 "rescinds the interpretive guidance" and directs firms to use Financial Accounting Standards Board rules or International Accounting Standards. This enables financial institutions to offer bitcoin and cryptocurrency services with fewer regulatory hurdles.

- The rescinded guidance, SAB 121, was endorsed by former SEC Chair Gary Gensler, who claimed it would safeguard investors in the event of bankruptcies. Mark T. Uyeda has replaced Genlser as Acting Chairman of the agency.

- SAB 121 mandated that cryptocurrency custody providers and exchanges account for customer holdings as both an asset and a liability on their balance sheets.

- In essence, banks can now hold and protect cryptocurrencies for their customers as they deem appropriate. Companies have the discretion to decide whether they need to acknowledge a liability for safeguarding risks and how to assess it.

- SAB 121 was seen as a significant obstacle in the Bitcoin and digital assets industry and was challenged by a Congressional Review Act resolution that passed both the House and Senate. However, it was vetoed by former President Joe Biden.

- Following the repeal of SAB 121, Preston Pysh, partner at ego death capital, now calls the US Congress to urgently pass a legislation that bans the rehypothecation of bitcoin.

SAB 122

Coindesk Article / Archive

The Block Article / Archive

- Do you want more? Subscribe and get No Bullshit GM report straight to your mailbox and No Bullshit Bitcoin on Nostr.

- Feedback or news tips? Drop it here.